•

•

A brokerage website in 2026 is much more than an online brochure. It is a compliance-savvy platform that combines trading infrastructure, handles regulatory disclosures in multiple regions, and turns qualified visitors into fully funded traders. The cost of a broker website is a reflection of this complexity, ranging from $5,000 for simple templates to $50,000+ for custom-built enterprise-level platforms. The vast majority of agencies give generic estimates that simply don’t factor in the cost of integration, compliance cycles, and optimization after deployment. This analysis will help you understand what really drives the cost of developing a brokerage website, where the hidden costs are, and when expert development pays off.

Key Takeaways

Pricing for brokerage website development on the brokerage website development platform varies from $3,000 for templates to $50,000+ for advanced custom platforms

The main factors that contribute to the costs of development are compliance requirements, integrations, and complexity of design

Template solutions create false savings—customization costs often exceed custom builds within 18 months

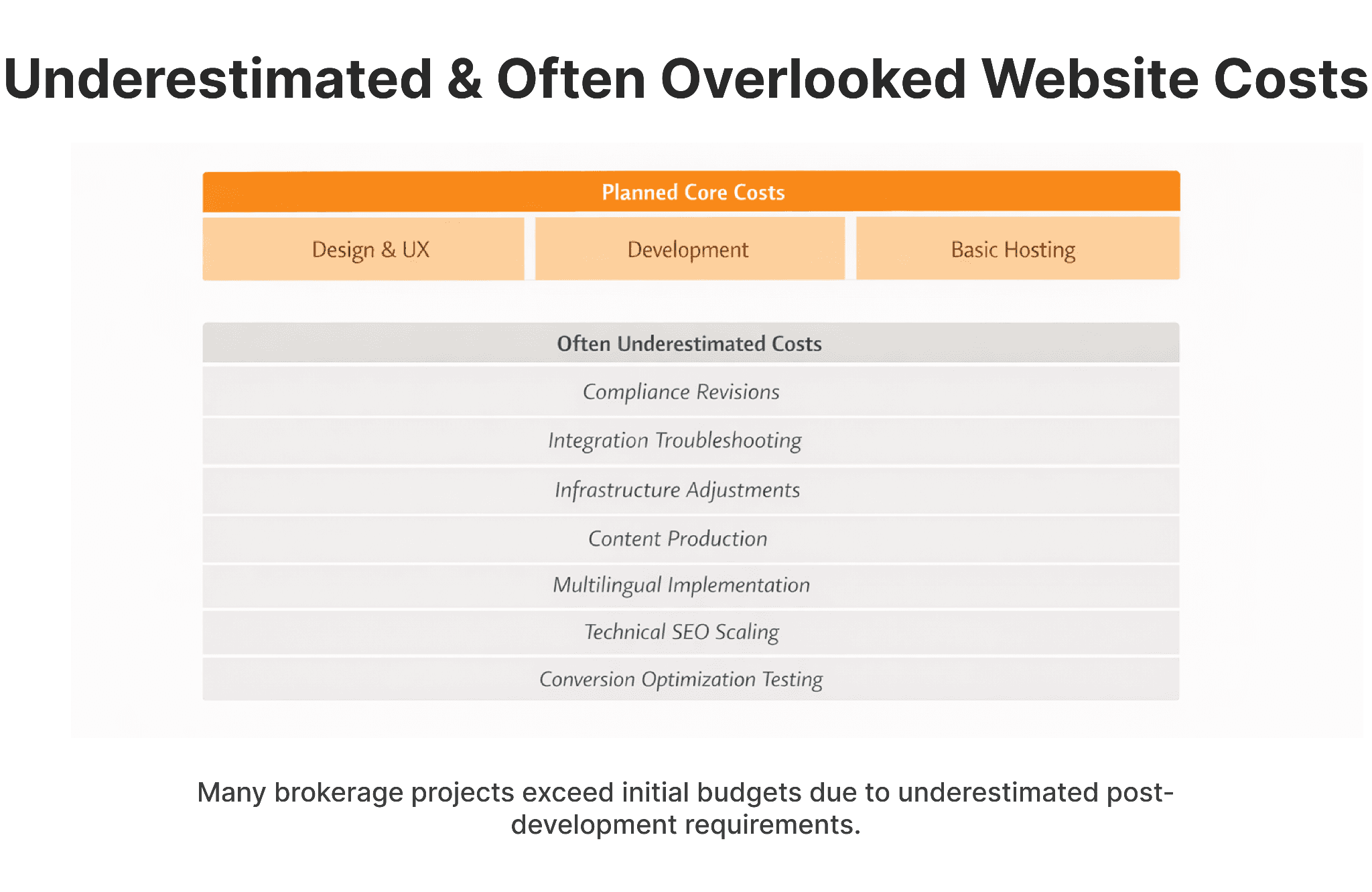

Hidden costs include compliance rewrites, content production, and integration troubleshooting

Custom broker websites deliver higher conversion rates and faster regulatory approval

Monthly costs vary from $600 to $2,500 depending on the growth plan

Fintech agencies help in reducing rework and obtaining compliance approval quickly

What Is the Average Broker Website Cost in 2026?

The average broker website price in 2026 is entirely dependent on the complexity of the project, the requirements for compliance, and the level of technical complexity involved.

This is the honest pricing breakdown:

Basic Template Website: $3,000-$7,000

This option uses pre-built templates customized with your branding, featuring a simple page layout with minimal customization. The package includes 5-8 pages of standard content, template-driven design, basic CMS setup, and mobile optimization.

What's not included: This tier does not include compliance structure, complex integration, or conversion rate optimization.

Professional No-Code Custom Website (Webflow/Framer): $8,000-$20,000

These are custom-designed websites built on flexible platforms with brand-specific UX and content structure. The package includes 10-20 pages of content, custom brand identity, compliance-driven design, basic integration with CRM and analytics, multilingual support, and performance optimization.

Advanced Custom Brokerage Platform Website: $20,000-$50,000+

This tier covers enterprise-level platforms that require complex integration, multi-jurisdictional compliance, advanced conversion optimization, and custom functionality. You'll receive 20+ pages of content, full brand identity, multi-jurisdictional compliance solutions, complex integration with MT4/MT5, cTrader, and KYC/AML systems, SEO optimization for multiple languages, custom onboarding flow, and comprehensive testing.

The brokerage website development cost represents the upfront build expenses. Beyond the initial development, ongoing maintenance, content production, SEO, and optimization typically add $600-$2,500 monthly, depending on your growth strategy.

What Factors Influence Brokerage Website Cost?

Six primary factors determine final broker website pricing—each with compounding effects on budget and timeline.

1. Scope & Number of Pages

A 5-page site costs fundamentally less than a 20+ page structured platform. Core pages form the minimum viable structure. Education sections, asset class pages, regulatory disclosure libraries, blog structures, and multi-language sites all increase development time. Each new page means new designs, new content, new regulatory reviews, and new development work.

2. Design Complexity

Template-based designs are less expensive to build but provide less room for differentiation in competitive industries. Custom brand identity development, such as color schemes, typography, component design, and conversion-driven UX design, raises the initial cost but provides a long-term competitive advantage. Highly converting broker website design involves flow analysis, competitor research, and testing.

3. Compliance Requirements

Regulatory compliance represents one of the largest hidden cost drivers. Risk disclosures must appear prominently across jurisdiction-specific pages. FCA-regulated brokers require different disclosure language than CySEC or ASIC entities. Legal review cycles add weeks to timelines. Compliance-aware developers structure content to accommodate these requirements from the start.

4. Integrations

Modern brokerage websites designs involve the integration of several systems. CRM system integration helps with lead capture and lead nurturing. Trading platform integration (MT4, MT5, cTrader) helps with access to the account dashboard. KYC/AML onboarding platforms help with automated verification. Analytics system implementation helps with conversion optimization. Each of these integrations involves custom development and maintenance.

5. Multilingual Setup

Expanding to multiple regions involves more than just translation. Each localized version of the website requires content that's relevant to the specific region, compliance messages tailored to local regulations, SEO optimization for the target market, and support documentation written in the local language. Translation management tools, hreflang attributes for search engines, and regional URL structures all add layers of complexity to the development process.

6. Performance Optimization

Core Web Vitals directly impact both your conversion rates and search engine rankings. Fast-loading pages don't happen by accident—they require image optimization, clean code, proper CDN configuration, and careful script management. Experienced developers build speed into the foundation of a website rather than trying to retrofit it later.

Brokerage Website Development Timeline: What to Expect

Understanding how long does it take to build a brokerage website helps set realistic launch expectations and budget allocation.

Template Deployment: 2-4 Weeks

This includes template selection, brand customization, basic page configuration, compliance language integration, CRM setup, and legal review. Total investment: $3,000-$8,000. Keep in mind that compliance requirements often extend timelines by 2-4 weeks, which can delay your market entry date.

Custom Development: 6-10 Weeks

The process involves discovery and strategic planning (1-2 weeks), custom design system and brokerage UX design (2-3 weeks), development and CMS implementation (2-3 weeks), and content implementation with compliance review (1-2 weeks). Total investment: $10,000-$25,000. A thorough compliance review cycle helps accelerate regulatory approval down the line.

Enterprise Platform: 12-16 Weeks

This comprehensive timeline includes in-depth discovery and multi-jurisdictional compliance review (2-3 weeks), complex design system and conversion rate optimization (3-4 weeks), trading platform website development with complex integrations (4-6 weeks), and multi-language implementation and testing (3 weeks). Total investment: $25,000-$50,000+.

The brokerage website development timeline directly correlates with cost. Rushed development often leads to expensive post-launch fixes that exceed any initial savings. Most successful brokerages allocate 8–12 weeks for professional custom development that balances speed with quality.

Template vs Custom Broker Website Pricing

The broker website template vs custom decision shapes both immediate costs and long-term ROI.

Comparison Table: Template vs Custom Development

Feature | Template Website | Custom Website |

|---|---|---|

Upfront Cost | $3,000–$8,000 | $10,000–$30,000+ |

Timeline | 2–4 weeks | 6–12 weeks |

Design Uniqueness | Generic, shared design | Fully custom brand identity |

Compliance Architecture | Basic, requires customization | Built-in from start |

Conversion Optimization | Minimal, not tested | Engineered for conversion |

SEO Foundation | Limited technical SEO | Comprehensive SEO architecture |

Integration Flexibility | Restricted by template | Unlimited custom integrations |

Scalability | Difficult, expensive to expand | Easy, designed for growth |

First-Year Total Cost | $8,000–$23,000 | $10,000–$30,000 |

Typical Conversion Rate | 0.8%–1.5% | 2%–4% |

Template Websites

Pros:

Lower upfront fintech website investment ($3,000–$8,000)

Faster initial deployment (2–4 weeks)

Lower technical barrier to launch

Cons:

Generic design reduces brand differentiation

Compliance risks from inflexible structure

Limited SEO architecture

Poor conversion optimization

Expensive customization requirements emerge within 12 months

Integration limitations restrict growth

Typical forex broker website cost using templates: $3,000–$8,000 initial, but customization requests often add $5,000–$15,000 within the first year based on industry project data.

Custom Broker Websites

Pros:

Unique brand positioning

Conversion-engineered user flows

Compliance-aware architecture from launch

Scalable CMS enables efficient content growth

Better long-term ROI through higher conversion rates

Professional credibility attracts institutional clients

Cons:

Higher upfront investment ($10,000–$30,000+)

Longer development timeline (6–12 weeks)

Requires strategic planning and content preparation

Typical custom broker website: $10,000-$30,000+ depending on complexity.

Hidden Costs Most Brokerage Founders Don't Expect

Most brokerage website development cost estimates exclude critical post-proposal expenses.

Content Production

The cost of professional copywriting for 15-20 pages is $2,000-$5,000. Most founders underestimate the amount of content needed for educational sections, trading guides, asset class descriptions, and compliance pages.

Compliance Rewrites

Legal teams frequently require multiple revision cycles. Each iteration adds 1–2 weeks and $500–$2,000 in writing and development costs.

Integration Troubleshooting

CRM, trading platform, and KYC system integrations rarely work perfectly on first deployment. Budget $1,000–$3,000 for integration debugging and optimization.

Multilingual Expansion

Adding languages after the launch will be much more expensive than building a multilingual system right from the start. The price for each additional language is $2,000-$5,000.

Hosting Upgrades

Hosting templates ($10-$30/month) will not be able to handle traffic growth. Enterprise hosting with CDN, security, and performance optimization: $100-$500/month.

Ongoing SEO

To rank for competitive brokerage keywords, one needs to constantly create content, optimize, and build links. This will cost $1,000-$3,000 per month for professional SEO services.

Conversion Optimization Testing

A/B testing landing pages, optimizing CTAs, and improving user flows is an ongoing process that requires investment. Spend $500-$2,000/month on major optimizations.

The hidden costs tend to be equivalent to or even exceed the development budget in the initial year. Professional companies segment their costs to factor in the hidden costs from the onset to avoid any surprises along the way during the development and launch process.

Ongoing Costs After Launch

A brokerage web infrastructure requires continuous investment beyond initial development.

Hosting & Platform Fees: $100-$500/month

Enterprise hosting with CDN, SSL, security monitoring, and backups. Template sites (WordPress) need security plugins and updates. Professional platforms (Webflow, Framer, custom) include hosting in monthly subscriptions.

Maintenance & Updates: $300-$1,000/month

Ongoing CMS updates, security fixes, content uploads, page changes, and tech support. Maintenance contracts ensure site health and prevent degradation and security issues.

SEO & Content Publishing: $500-$2,000+/month

Competitive brokerage SEO requires content creation, tech optimization, backlink development, and performance analysis. Organic search engine optimization reduces reliance on paid acquisition.

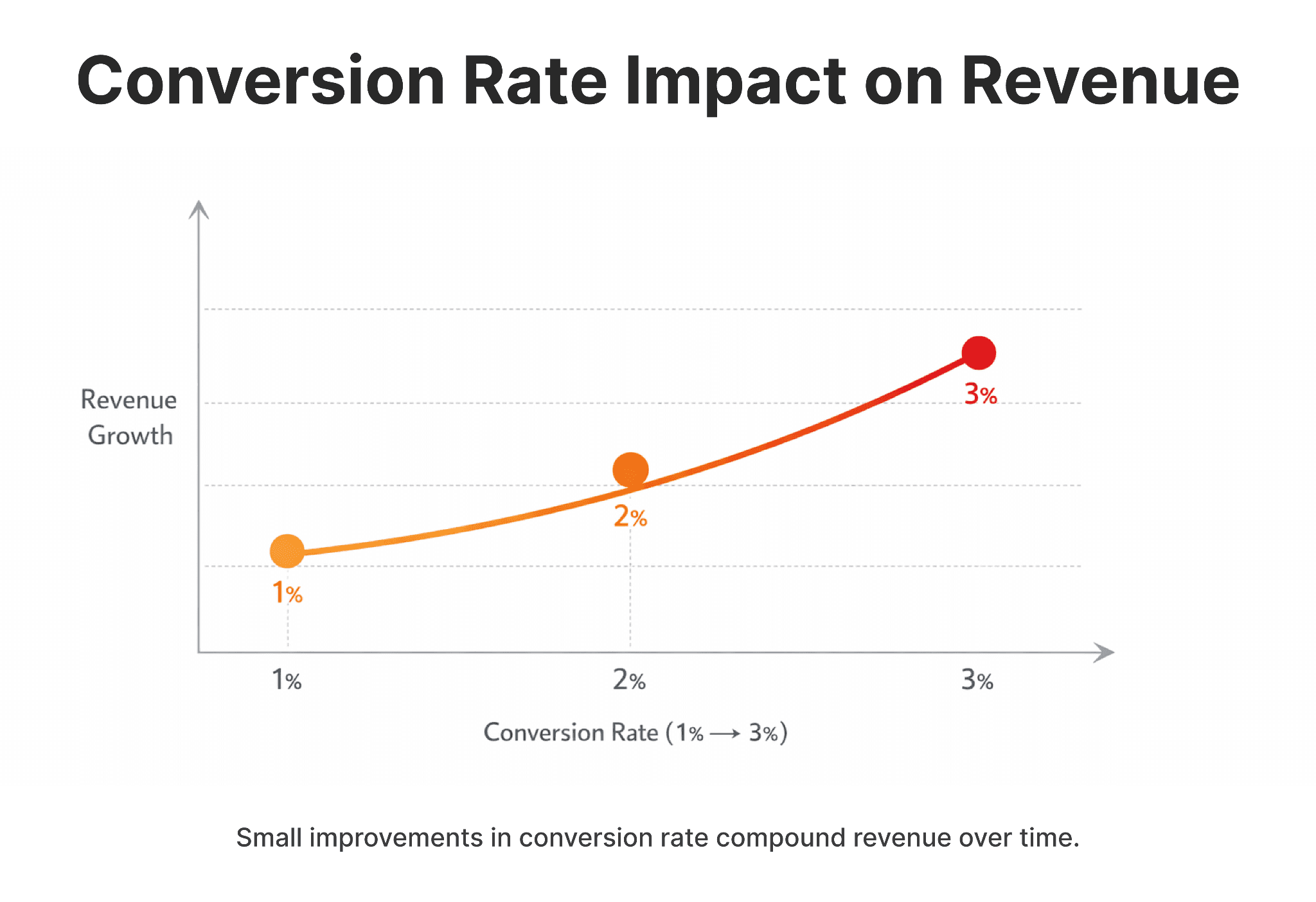

Conversion Optimization: $500-$1,500/month

A/B testing, heatmap analysis, user flow optimization, CTA optimization, and landing page optimization. Ongoing optimization multiplies conversion rate gains.

Realistic monthly totals:

Static maintenance approach: $600-$1,200/month

Growth-focused strategy: $1,500-$2,500+/month

Brokerages viewing websites as static properties tend to experience static growth. Businesses prioritizing ongoing improvement tend to experience compounding growth from enhanced traffic, conversion rates, and revenue streams.

How to Reduce Broker Website Cost Without Sacrificing Quality

Strategic planning significantly reduces waste without compromising results.

1. Define Scope Clearly Before Design Starts

Unclear requirements cause expensive mid-project changes. Document all pages, integrations, and features before starting development. A thorough scope document helps avoid scope creep and cost overruns.

2. Early Preparation of Compliance Documentation

Collect regulatory requirements, disclosure text, and legal guidelines before the copywriting process starts. Early compliance document preparation helps avoid costly revision cycles.

3. Mid-Project Pivots Are Costly

Design changes or incorporating new features in the middle of a project increases costs. Strategic planning should occur before moving forward with development.

4. Prioritize Conversion-Critical Pages

Launch with core conversion pages (homepage, trading conditions, account types, platform pages) and add educational content post-launch. Phased deployment reduces initial investment while delivering immediate business value.

5. Choose Scalable Platforms

Webflow and Framer help manage content efficiently, update content easily, and modify designs as needed without involving developers. Scalable platforms lower the cost of maintenance over time compared to custom-developed or WordPress-based solutions.

6. Partner with Agencies Specializing in Fintech

General web development agencies lack expertise in brokerage compliance, trading platform integration, and regulatory requirements. Fintech agencies design architecture that is compliance-aware from the outset, thus shortening the cycle of revisions and obtaining regulatory approvals quickly.

Based on internal project data, unclear scope drives a significant portion of budget overruns. Detailed planning before development starts eliminates most cost surprises.

When Paying More Is Actually Cheaper

Higher upfront fintech website investment often delivers better ROI through measurable business outcomes.

Higher Conversion Rates Offset Cost Differences

A template site converting at 1% costs effectively more than a custom site converting at 2.5%. If a custom broker website costs $15,000 more but significantly improves conversion rates, the investment can pay back within several months of operation.

Example: A brokerage spending $5,000 monthly on paid traffic with 1% conversion acquires 50 leads. At 2.5% conversion, the same budget acquires 125 leads—75 additional leads monthly. If average client lifetime value is $500, the additional conversion generates substantially more monthly revenue. Professional custom development typically delivers measurably higher returns.

Faster Compliance Approval Saves Months

Regulatory authorities scrutinize websites carefully. Compliance-aware architecture accelerates approval. Delays of 2–3 months waiting for website revisions cost far more than professional development. Lost market opportunity, delayed revenue, and regulatory friction create significant hidden costs.

Better SEO Reduces Paid Acquisition Dependency

Template sites lack SEO architecture. Custom platforms developed with technical SEO fundamentals achieve faster rankings, gain organic traffic faster, and depend less on paid advertising. A $20,000 development budget for a broker site that attracts 1,000 organic visitors per month can cut $3,000 to $5,000 in paid advertising expenses per month.

Strong Brand Credibility Increases Trader Trust

Professional design signals operational maturity. Traders deposit more with brokers demonstrating institutional credibility. A template site may save $10,000 but potentially lose high-value clients who expect professional presentation. Custom branding attracts institutional traders with larger deposit volumes.

The lowest broker website pricing rarely delivers the best business outcome. Strategic investment in quality development typically generates measurable returns through higher conversion, faster growth, and lower acquisition costs over the platform's lifecycle.

When to Hire a Fintech Web Development Agency

If you're evaluating agencies for your trading platform website cost, understanding the difference between generalist web development and fintech web development agency specialization is critical.

Why Generalist Agencies Struggle with Brokerage Projects

Generalist web agencies are great at e-commerce, SaaS, or business websites. Brokerage websites demand a completely different set of skills. Generalist agencies lack knowledge of regulations, fail to comprehend trading user psychology, and have not implemented MT4/MT5 platforms or KYC/AML systems. This results in changes in compliance, integration issues, and conversion-destroying UX decisions.

What Fintech Specialization Delivers

Specialist agencies are well-versed in FCA, CySEC, ASIC, and other regulatory requirements. They organize content in a way that allows for easy adaptation to regional requirements, cutting down on legal approval times. Converting visitors to funded traders demands knowledge of trader psychology, decision-making, and conversion points that are vastly different from e-commerce.

Account opening processes are integrated with various systems, such as registration, KYC, document upload, deposit, and access to the platform. Technical experts design these processes to achieve the highest possible completion rates. The integration of MT4, MT5, cTrader, custom platforms, CRM, and payment systems demands certain technical expertise that fintech web development companies have gained from their experience with numerous projects.

For brokerages evaluating long-term website infrastructure decisions, working with a team experienced in regulated fintech environments can significantly reduce implementation risks and revision cycles.

WSA focuses exclusively on brokerage and fintech website development, with emphasis on compliance-aware structure, scalable architecture, and conversion-focused user experience across multiple jurisdictions.

Final Verdict: What Should You Budget in 2026?

Realistic brokerage website pricing expectations for 2026:

Early-Stage Brokers: $8,000–$15,000

Sufficient for professional custom design, compliance-aware structure, necessary integrations, and scalable CMS. This will provide sound launch infrastructure without unnecessary complexity.

Scaling Brokers: $15,000–$30,000

Includes advanced integrations, multilingual setup, conversion optimization, comprehensive SEO architecture, and sophisticated brand identity. Appropriate for brokers targeting multiple regions or premium market segments.

Complex Multi-Region Brokers: $25,000–$50,000+

Enterprise-level solutions with compliance modules for specific regions, sophisticated trading platform integrations, tailored features, and extensive testing. Needed for enterprise-level trading or complex regulatory environments.

Broker website pricing is based on strategy, not page number. A site with 10 pages and complex functionality and regulatory requirements will cost more than a 20-page site with simple features.

The lowest-priced solution is not always the best choice. Expert training from fintech experts minimizes risk, speeds time to market, and provides clear ROI with increased conversion and process efficiency.

While budget ranges vary based on scope and regulatory complexity, some brokerages begin with focused landing-page infrastructure before expanding into full-scale platforms.

WSA offers structured website solutions starting from approximately $5,000 for compliance-aware landing pages, with custom brokerage platforms typically ranging between $8,000 and $15,000 depending on integrations and scope. Detailed pricing overview is available at WSA pricing page.

Frequently Asked Questions

How much does a forex broker website cost in 2026?

The cost of a forex broker website can vary between $8,000 and $30,000 for custom development. Template-based development begins at $3,000, but customization costs between $5,000 and $15,000 in the first year. The cost of development also depends on the number of pages, regulatory requirements, integration with trading platforms such as MT4 or MT5, multi-language development, and complexity of design. Forex brokers with operations in multiple countries require regulatory-compliant designs that support FCA, CySEC, or ASIC regulations, thus expanding the scope of development. Successful forex brokers spend between $12,000 and $25,000 for platforms that can efficiently turn visitors into funded traders.

What's included in brokerage website development cost?

The cost of brokerage website development may include things such as custom design and branding, responsive design for all devices, implementation of CMS for content management, basic page structure (10-20 pages), basic integration with CRM and analytics systems, compliance-friendly content structure, mobile optimization, and basic SEO setup. However, the cost of brokerage website development may not include things such as content creation, copywriting for all pages, advanced integration with trading platforms, translation for multiple languages, post-launch SEO services, hosting costs, and maintenance contracts. The hidden costs involved in brokerage website development may include things such as compliance rewrites, integration issues, content creation, and conversion optimization.

Is a custom broker website worth the extra cost compared to templates?

Yes, custom broker websites will usually provide a better ROI investment over templates, although they cost more. Custom development will cost between $10,000 to $30,000, but it will provide better conversion rates, better brand differentiation, faster regulatory approval due to compliance-aware design, and better scalability as your brokerage grows. Template websites will cost between $3,000 to $8,000, but they will be expensive to customize after 12-18 months, provide poor conversion rates, pose compliance issues, and are inflexible for integration. The difference in cost between a template and a custom website will pay for itself in a matter of months with better conversion rates and lower paid acquisition costs. Custom development is usually the best option for brokers who are serious about their business.

What are the ongoing costs after launching a brokerage website?

The monthly expenses that come after launching a brokerage website can range from $600 to $2,500. The cost of hosting and platforms can range from $100 to $500 per month, depending on the kind of infrastructure that is required. The cost of maintenance and updates can range from $300 to $1,000 per month, depending on the requirements. The cost of SEO and content creation can range from $500 to $2,000+ per month, depending on the requirements. The cost of conversion optimization can range from $500 to $1,500 per month, depending on the requirements. Brokers who consider their websites as static resources will incur minimal expenses, ranging from $600 to $1,200 per month. However, they may not see much growth. Brokers who are focused on growth will incur expenses ranging from $1,500 to $2,500 per month.

How can I reduce brokerage website costs without sacrificing quality?

Reduce costs strategically by defining exact scope before development starts—unclear requirements cause expensive mid-project changes. Prepare all compliance documentation, legal disclosures, and regulatory requirements before copywriting begins to eliminate revision cycles. Avoid design pivots or feature additions during development. Prioritize conversion-critical pages for initial launch and add educational content afterward in phases. Choose scalable platforms like Webflow or Framer that reduce long-term maintenance costs and developer dependency. Work with fintech-specialized agencies who understand brokerage compliance, trading platform integrations, and regulatory requirements—they reduce rework and accelerate approval. Unclear scope of work is a significant cost driver, according to project experience. Detailed planning before development eliminates most waste.

Whether you’re launching something new or improving an existing platform, we’re ready to discuss your goals and explore the best way forward.