•

•

A forex broker website does not fail because of traffic. It fails because of structure and trust gaps.

Most brokerage founders treat low sign-ups as a marketing problem — increasing ad spend while demo registrations stay flat. The bottleneck is almost always the website itself, not the acquisition channel.

Today’s traders move fast and filter hard. They verify spreads, locate platform download links, and scan for trust signals within seconds. Any signal that is missing, buried, or ambiguous ends the session.

Understanding how to build a forex broker website that converts means getting the architecture right: conversion structure, trust design, onboarding flows, mobile UX, performance, and analytics. This guide covers each element for broker teams operating in competitive, regulated markets.

Key Takeaways

Most broker websites fail on conversion — not on traffic. The problem is structural.

A high-converting broker website is built around trust, speed, mobile UX, and a clear registration path.

Compliance elements (FCA, CySEC badges, risk disclosures) are conversion signals — not legal formalities.

The demo account registration flow is the highest-leverage conversion point on any forex broker website.

Without structured GA4 event tracking, broker websites lose registrations daily without knowing why.

Specialist fintech agencies outperform general web agencies because they design for regulated environments.

What Makes a High-Converting Broker Website?

A high-converting broker website removes friction, establishes trust immediately, and moves users toward registration without ambiguity. These are structural requirements — not design preferences.

In competitive broker markets, weak broker website UX directly reduces registration volume. A forex broker website that looks strong but lacks a clear conversion path will consistently underperform against structurally sound competitors, regardless of traffic quality.

The gap between a site converting at 2% and one converting at 8% is rarely visual. It is architectural. Layout, content hierarchy, compliance positioning, and page performance collectively determine whether a visitor registers or exits to a competitor.

Five core pillars define every high-converting broker website:

Clear positioning: the visitor knows within five seconds who the broker is for, what instruments are offered, and why they should trust the brand.

Trust architecture: regulatory credentials, risk disclosures, payment logos, and SSL are visible at decision points — not buried in footers.

Logical onboarding flow: the path from landing page to completed registration is short and frictionless. Every additional step reduces completion rate.

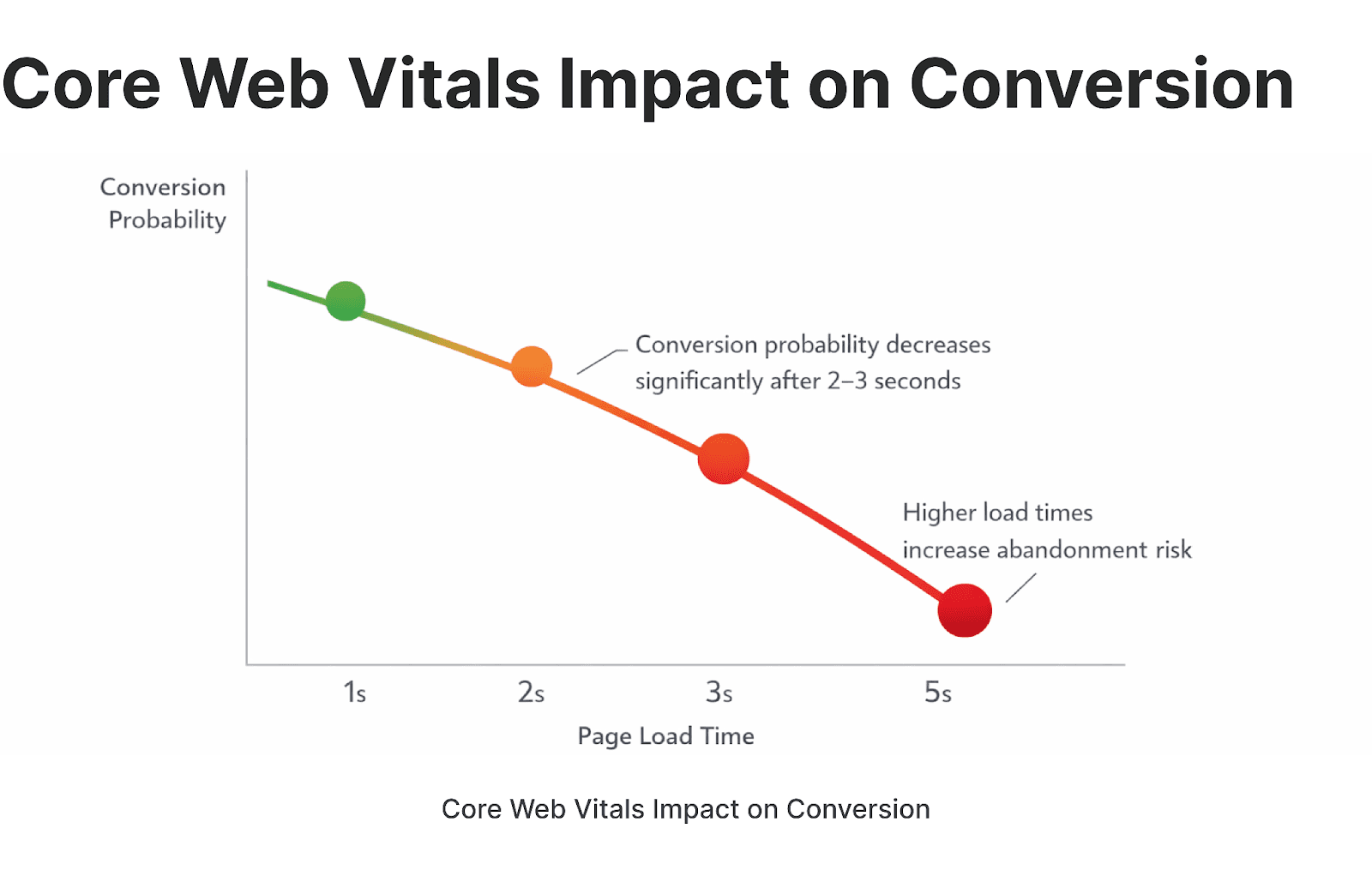

Performance and speed: pages load in under two seconds. Every additional second raises abandonment and acquisition cost.

Mobile-first experience: over 50% of forex and CFD traffic is mobile. A degraded broker website UX eliminates the majority of visitors from the conversion funnel.

Why Most Forex Broker Websites Don’t Convert

The diagnostic below identifies the structural problems that directly suppress broker website conversion rates.

Problem | Why It Kills Conversions |

|---|---|

Overloaded homepage | Traders cannot identify the key offer or next step. Cognitive load rises; bounce rate follows. |

No clear CTA hierarchy | ‘Open Account’, ‘Download MT4’, and ‘Contact Us’ at equal visual weight — traders do nothing. |

Hidden fees or spreads | Opacity reads as a red flag in regulated markets, not discretion. |

Compliance buried in footer | Signals to experienced traders that the broker is unregulated or concealing its status. |

Slow load times | Pages over three seconds lose up to 40% of visitors. In paid campaigns, this is directly wasted budget. |

Generic template design | In financial services, design communicates credibility. Generic templates signal an unestablished brand. |

No mobile optimisation | Near-zero mobile conversion for brokers with majority mobile traffic — a growth-blocking failure. |

Weak social proof | No testimonials or verified client count. Unsubstantiated claims do not substitute for evidence. |

Three or more of these on the same site indicates structural failure. Cosmetic changes will not resolve it. A systematic rebuild is required.

Step 1. Clarify Your Value Proposition Above the Fold

The above-the-fold section has a single function: make the visitor understand immediately who the broker is for, what is offered, and why they should act. Failure here ends the session before it begins.

Apply the five-second clarity test: show the page to someone unfamiliar with the broker. If they cannot answer ‘who is this for, what do they trade, and why trust this company’ inside five seconds, registrations are being lost at the entry point.

A converting above-the-fold section requires:

A headline naming the audience and offer: e.g., ‘Trade Forex with FCA-Regulated Conditions’ — specific, not generic.

A specific sub-headline: spreads, platform, and instrument count.

A primary CTA in a contrasting colour. One action — not three.

A secondary CTA (‘View Trading Conditions’) to retain traffic not yet ready to register.

One trust signal in the hero: a regulatory badge (FCA, CySEC, ASIC) or a verifiable metric.

Generic positioning (‘Trade the World’s Markets’) converts accordingly — poorly. Audience-specific messaging is not optional.

Step 2. Structure the Website Around Conversion Paths

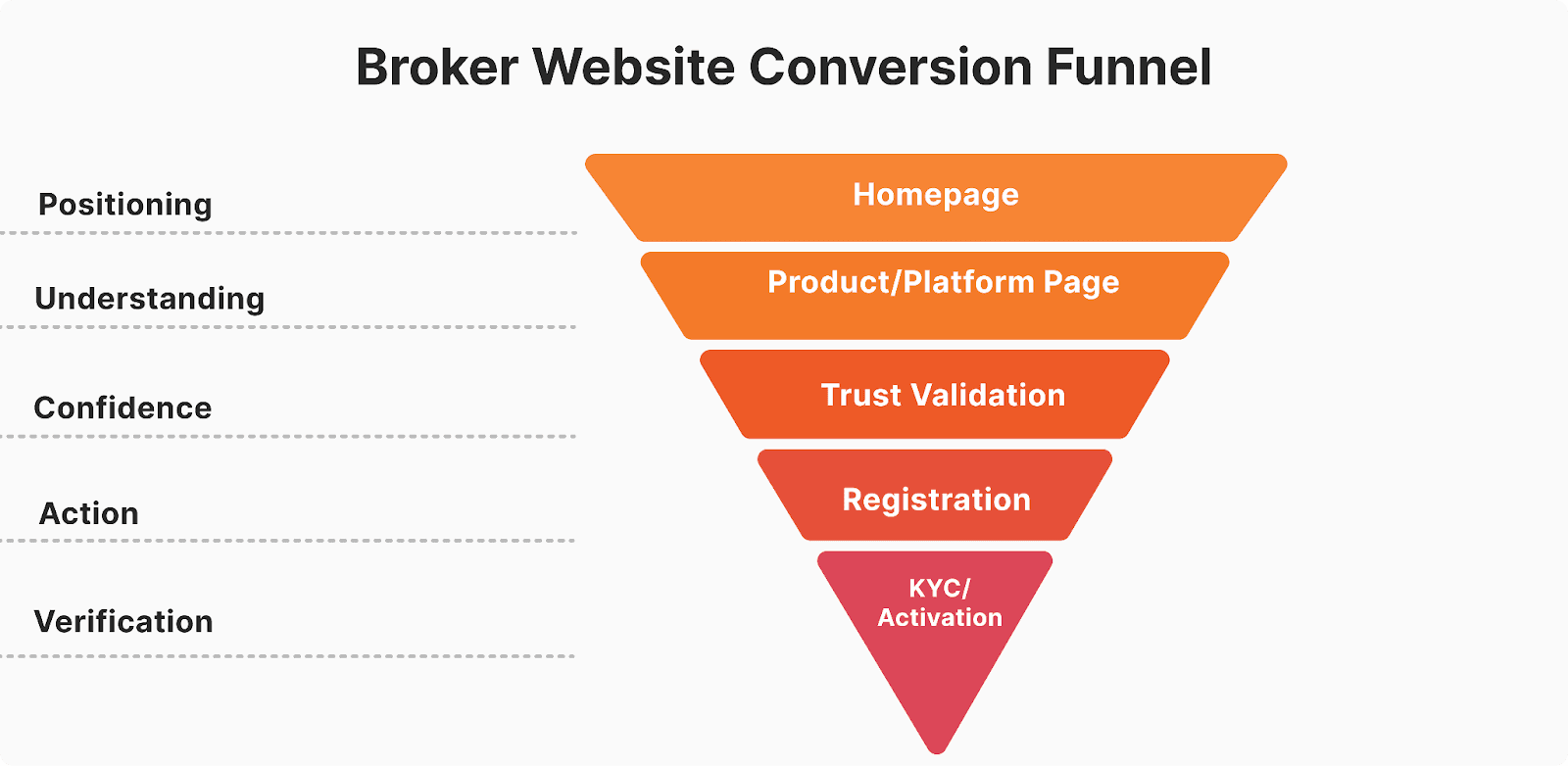

Broker website structure is a conversion decision, not an aesthetic one. Most broker website builds fail here because they are organised around what the company wants to display, not around the sequence a trader must follow before registering.

Stage | Purpose |

|---|---|

1. Landing Page / Homepage | First impression — positioning + value prop |

2. Product / Platform Page | Instruments, trading conditions, MT4/MT5 |

3. Trust Validation | Regulatory badges, fees, testimonials, disclosures |

4. Registration Page | Demo or live account sign-up form |

5. KYC / Onboarding Flow | Identity verification, account activation |

Each page has a defined role. The homepage converts intent to interest. Product pages convert interest to understanding. Trust pages convert understanding to confidence. The registration page converts confidence to action. A page that tries to execute the entire funnel at once accomplishes none of it.

Specialist agencies approach broker website structure differently from generalist developers, designing each page explicitly around its role in the conversion path.

Demo-First vs. Live-First Registration Strategy

Choosing the wrong registration strategy suppresses broker website conversion before any UX optimisation can take effect.

Demo-first is the correct default for most startup and early-stage brokers. It reduces friction and produces a measurable demo account conversion rate as the primary KPI. Live-first generates higher-intent leads but narrows the funnel significantly.

Strategy | Best For |

|---|---|

Demo-first (lower friction) | Early-stage brokers, emerging markets, evaluation-phase traders |

Live-first (higher intent) | Established brokers with strong brand recognition |

Platform pages — MT4, MT5 downloads, WebTrader, mobile app — must be directly accessible from main navigation. Burying platform information is a structural conversion error.

Step 3. Build Trust Before Asking for Registration

Broker website trust signals are conversion elements, not compliance formalities. Regulatory badges, risk disclosures, and payment provider logos directly determine whether a trader proceeds to registration or exits to a competitor.

Experienced traders actively screen for legitimacy signals before engaging with any registration flow. If those signals are absent, poorly placed, or de-emphasised, even a technically excellent broker onboarding flow will not convert.

Required trust elements:

Regulatory badges (FCA, CySEC, ASIC, FSCA): displayed in the hero, navigation bar, and footer — not only the footer. The FCA Financial Services Register publishes verifiable data that traders routinely cross-check. Regulatory visibility is a competitive requirement.

Risk disclosures: visible on all product pages, not confined to a legal disclaimer page.

SSL / HTTPS: non-negotiable. Browser security warnings destroy conversion at first contact.

Payment provider logos: positioned near the registration CTA at the point of commitment.

Testimonials and media mentions: specific, verifiable, and from credible industry sources.

Trust architecture determines where signals appear at each funnel stage — not merely whether they exist on the site.

Micro-case study: In one forex broker website redesign, relocating regulatory credentials from the footer to the homepage hero increased demo account starts by 17% within 30 days — with no change in traffic volume.

[aa fast-fact]

Compliance ≠ Friction — It Is a Conversion Asset

FCA, CySEC, and ASIC registration are verifiable competitive differentiators.

Displaying them prominently is not a legal obligation to reluctantly fulfil — it is a conversion lever to actively deploy.

[/aa]

Step 4. Optimise the Broker Onboarding Flow

The broker onboarding flow — the sequence between clicking ‘Open Account’ and completing registration — is where the majority of broker website conversions are lost. Friction at any stage directly reduces the number of traders who reach a funded account.

Even high-intent traders abandon when forms are too long, steps are unclear, or KYC requirements appear before trust has been established. A technically compliant broker onboarding flow that ignores UX principles will consistently underperform a streamlined one.

Minimise step count. Demo: three to four steps. Live account: no more than six stages.

Show progress. A visible progress bar sets expectations. Traders complete known processes — they abandon unknown ones.

Delay KYC. Request identity documents when the trader is ready to deposit — not before they have experienced the platform.

Save progress. Forced restarts eliminate a significant proportion of near-complete registrations.

Confirm each stage. State clearly what was completed and what follows.

Track every step in GA4. Without step-level data, onboarding problems are invisible.

The most common broker onboarding flow failure is premature KYC. Platform exposure must precede identity verification.

Conversion Benchmark Check

If demo conversion remains below industry benchmarks, structural optimisation of the broker onboarding flow and trust architecture should be prioritised before increasing acquisition spend.

Step 5. Broker Website Speed and Performance

Broker website speed is a direct conversion variable. Google data shows that as load time increases from one to three seconds, mobile bounce probability rises by 32%. Slow load times signal an unprofessional operation and erode trust before the trader has engaged.

The benchmark for a converting brokerage website is sub-two-second FCP on desktop and mobile, measured via Google PageSpeed Insights. Sites that miss this threshold lose traders to faster competitors on every traffic source.

Core performance requirements: CDN for latency reduction across jurisdictions; WebP and lazy loading for image compression; async JavaScript to prevent thread blocking; TTFB under 200ms. Core Web Vitals — LCP, CLS, and INP — affect both organic rankings and user experience. A homepage failing Core Web Vitals pays a ranking penalty on every keyword and compounds the cost of every paid click.

Metric | Good | Needs Work | Poor |

|---|---|---|---|

LCP (Load) | < 2.5s | 2.5s – 4.0s | > 4.0s |

INP (Interaction) | < 200ms | 200 – 500ms | > 500ms |

CLS (Stability) | < 0.1 | 0.1 – 0.25 | > 0.25 |

TTFB (Server) | < 200ms | 200ms – 500ms | > 500ms |

Broker websites failing these Core Web Vitals benchmarks actively suppress organic visibility, increase acquisition costs, and signal unreliability to the traders they are trying to retain.

Step 6. Mobile UX for Broker Websites

Broker website UX on mobile is the primary channel — not a secondary consideration. Over 50% of forex and CFD traffic arrives on mobile, with the proportion substantially higher in Southeast Asia, the Middle East, and Africa.

A degraded mobile registration experience does not create friction for some users — it blocks the majority of potential registrations. Nielsen Norman Group research consistently identifies mobile form completion failures as primary abandonment drivers in financial services. These are solvable engineering problems, not acceptable trade-offs.

Mobile UX requirements:

CTAs reachable without scrolling. Fixed-bottom CTAs are effective on long-form pages.

Large, tap-accurate form fields with correct keyboard types and inline real-time validation.

Tap-based navigation — mouse-over sub-menus are non-functional on touchscreens.

Core information (regulatory status, spreads, platform access) reachable in two taps or fewer.

Real device testing across iOS Safari, Android Chrome, and Samsung Internet — automated tools miss what real devices surface.

Walk the full registration journey on a real device. Do this quarterly and after every significant site update.

Step 7. GA4 Analytics and Conversion Tracking

Without structured analytics, broker website conversion data is invisible. Conversion decisions made without funnel data are guesses. In competitive broker markets, guessing while competitors measure is a structural disadvantage.

Deploy GA4 from launch. Broker websites that go live without event tracking have no mechanism to diagnose conversion problems or measure the impact of changes.

Track at minimum: registration start; email entry; account type selection (Demo vs. Live); KYC initiation; registration completion; platform download (MT4/MT5); key CTA clicks across major pages.

Three diagnostic patterns appear consistently:

Drop between registration start and email entry: trust gap or unclear value proposition at first commitment.

Abandonment at account type selection: demo/live messaging confusion — a layout problem, not a product problem.

Drop-off at KYC initiation: the most common structural error in broker onboarding flow design. Premature identity verification — fully addressable.

GA4 is part of the conversion architecture. Instrument the funnel before making structural changes. Every change without a measurement baseline is a change without a result.

When to Redesign a Broker Website

A redesign is required — not optional — when incremental optimisation has reached its ceiling. Continuing to invest in paid traffic against a forex broker website that structurally cannot convert is a compounding acquisition cost problem.

Redesign signals:

Demo conversion below 1% despite sustained traffic — structural UX or trust failure. Traffic optimisation will not fix it.

Mobile bounce rate above 70% — the mobile architecture is broken.

Compliance changes requiring multi-page restructuring — retrofitting creates ongoing risk and inconsistency.

Core Web Vitals failures where technical debt makes remediation impractical without a rebuild.

Brand evolution (new regulation, new markets, rebrand) leaving the site architecturally misaligned.

Outdated CMS blocking performance, security, or MT4/MT5 integration requirements.

A redesign must be driven by performance data and a defined brief. Visual preference is not a business case.

DIY vs. Specialist — Who Builds a Converting Broker Website?

Three approaches dominate forex broker website development: DIY templates, general digital agencies, and specialist fintech agencies.

Broker websites operate within regulated environments that impose compliance, integration, and conversion architecture requirements that generic web development does not address. A site that ignores these constraints will require costly remediation before it converts competitively.

Approach | Characteristics |

|---|---|

DIY / Template | Fast to launch. Not built for compliance or conversion. MT4/MT5 integration requires significant additional development. Cost advantages disappear once remediation begins. |

General agency | Professional output. Lacks broker-specific compliance knowledge and conversion data. Defaults to generic best practice. |

Specialist fintech agency | Highest initial cost, highest return. Compliance-first hierarchy, native KYC optimisation, MT4/MT5 and CRM integration without separate teams. |

Templates optimise for looks. Specialists optimise for broker website conversion in regulated environments. The cost differential is typically recovered within the first 90 days through conversion performance alone.

Why Fintech-Specialised UX Outperforms General Agencies

A generalist agency will deliver a visually competent broker website. It will rarely deliver one that converts at a competitive rate — because converting traders in regulated markets requires domain knowledge that standard web development does not produce.

Stanford Web Credibility Research demonstrates that users in high-stakes environments form rapid trust judgements based on design quality, information architecture, and verifiable credentials — all domain-specific capabilities in financial services.

Fintech-specialised UX delivers: conversion-first architecture where every decision is evaluated against registration conversion rate; compliance built into the brief from day one (ESMA, FCA, CySEC requirements); accelerated delivery via reusable component libraries; and integrated SEO and performance architecture that generalist agencies frequently miss.

The WSA project portfolio spans startup brokers to established brands undergoing full redesign — every engagement grounded in funnel data and compliance requirements. This depth of regulated-market forex broker website development experience is what separates conversion-focused delivery from standard web projects.

Summary: How to Build a Forex Broker Website That Converts

Understanding how to build a forex broker website that converts requires all of the following working in combination:

Clear positioning above the fold

Conversion-focused broker website structure

Prominent trust architecture and compliance signals

Streamlined demo-first broker onboarding flow

Broker website speed benchmarks under two seconds

Broker website UX optimised for mobile as the primary experience

GA4 funnel tracking from day one, with ongoing optimisation

When these elements work together, broker website conversion rates improve measurably and hold at a higher baseline. When any element is missing or structurally weak, the entire funnel underperforms.

A demo conversion rate below 2% is a structural problem with a structural solution. Increasing ad spend against a fintech website that cannot convert does not improve the economics — it compounds them.

Frequently Asked Questions

What increases conversions on a forex broker website?

Structured GA4 funnel tracking followed by targeted structural fixes is the most reliable conversion improvement method. Deploy event tracking across the full registration funnel before making any structural changes. Priority actions: tighten the value proposition above the fold, reposition trust signals to high-visibility decision points, reduce step count in the broker onboarding flow, and resolve mobile broker website UX failures on high-traffic pages. Changes made without baseline data produce uncertain results.

What is a good demo account conversion rate?

A structurally sound forex broker website should achieve 3–8% demo conversion with targeted traffic. Rates below 1% indicate structural UX or trust failure — not a traffic quality issue. Rates above 10% are achievable with highly targeted paid traffic and a dedicated landing page. Always segment by traffic source — conflating organic, paid, and direct produces misleading averages.

Does compliance affect conversion on broker websites?

Prominent compliance signals increase conversion rates in regulated markets — they do not reduce them. FCA, CySEC, and ASIC badges placed at decision points increase conversions among experienced traders who actively screen for these signals. Treating compliance as visual clutter is a strategic error. In regulated markets, visible compliance is a competitive differentiator.

How important is mobile UX for broker websites?

Over 50% of broker website traffic is mobile — a broken mobile experience blocks the majority of registrations. Unresponsive forms, difficult navigation, and slow load times do not inconvenience a minority of visitors. They eliminate the majority. Broker website UX must be treated as the primary experience and tested on real devices, not browser emulators.

Redesign or optimise — which approach is right?

Optimise for discrete, addressable issues. Redesign when structural failures cannot be retrofitted. Optimise when problems are isolated: specific high-dropout pages or remediable performance issues. Redesign when problems are systemic: broken mobile architecture, irremediable compliance gaps, significant CMS technical debt, or brand positioning that has shifted substantially. Broker website builds converting below 1% on demo registration almost always require a redesign, not incremental optimisation.

Whether you’re launching something new or improving an existing platform, we’re ready to discuss your goals and explore the best way forward.