•

•

A forex broker website is not a marketing page. It is a core business asset that shapes how traders evaluate your credibility, how regulators assess your readiness, and how quickly your brokerage moves from concept to revenue.

Research from Stanford University shows that 75% of consumers judge a company's credibility based on website design alone. In the brokerage industry, the stakes are even higher. Traders are entrusting capital. Regulators are reviewing content for compliance. Partners and introducing brokers are deciding whether you are worth their referral network. All of that judgment begins on your website.

If you’re a brokerage founder anticipating launch, a marketing lead preparing for a site redesign, or an operations director considering turnkey platforms, what follows describes how to create a broker website from scratch.

Key Takeaways

The broker site should be designed with business objectives in mind, rather than focusing purely on making the site look good.

Clear site structure and compliance-ready pages need to be incorporated as early as possible, and not as an afterthought.

The UX quality and page load performance will have a direct influence on trust, registration, and regulation.

Modern platforms like Framer and Webflow enable professional broker websites in 4–8 weeks, far faster than traditional development.

A fintech-specialized design partner knows what regulators expect, what traders respond to, and where generalist agencies typically go wrong.

Step 1. Define the Goal of Your Broker Website

Every successful forex broker website begins with clearly defined business objectives, not a mood board. Before thinking about color schemes or button positioning, founders of a forex broker business need to clearly define what needs to be achieved by their website. This will ensure that even the best-looking website will be effective, or else.

For most brokerages, goals fall into four categories:

Lead generation

The site needs to attract traders through organic search, paid campaigns, and referrals — then turn that traffic into leads through registration forms, demo account sign-ups, or consultation requests. A high-converting broker website treats every page as a potential entry point and every section as part of the funnel.

Trader onboarding

Research conducted by Stanford found that as many as 75% of people judge the credibility of a company based on its website design. And it's not just the homepage that has to deliver; the whole onboarding process will work just like the overall design. A messy onboarding process tells the same story as a messy design: the people running this show are sloppy.

Partner and IB acquisition

The forex broker website appears to rely significantly on introducing brokerage companies. There is a need to include a separate part of the website that explains partnership schemes or models in detail.

Licensing and due diligence readiness

Regulators, banking partners, and liquidity providers also review the websites of the broking partners, and if the website does not display the necessary licensing and risk disclosures and transparent terms and conditions, the registration can be held up for months.

Define these goals before you create a forex broker website. They will shape every decision that follows.

Step 2. Plan Your Broker Website Structure

A clear, well-organized page structure improves usability, search engine optimization, and compliance preparedness simultaneously. The worst thing a new brokerage website can do is obscure essential information with complex navigation schemes or place relevant regulatory information in footnotes.

Here is the basic broker site structure that all forex broker websites require:

Homepage: Value proposition, trust indicators such as regulation badges, awards, and partner logos, and calls to action. The homepage must immediately answer: who is this broker, and why should I trust them?

Trading Products / Instruments: Markets offered, instrument specifications, and trading conditions. Traders compare these pages across brokers before making a decision.

Platforms: MT4, MT5, cTrader, web-based, mobile, and API. This should include screenshots, a detailed list of features, and download options.

Fees & Trading Conditions: Spreads, Leverage, Commissions, Swap Rates. Transparency here is non-negotiable.

Account Types: Clearly differentiated tiers for beginners, active traders, and professional clients.

Company / About: Company background, licensing, team, and office information.

Legal & Compliance Pages: Risk disclosure, terms & conditions, privacy policy, AML/KYC policy, and regulatory information (detailed in the next section).

Contact & Onboarding: Clear CTAs, live chat integration, support channels, and regional office details.

This brokerage website structure supports both search engine visibility and regulatory review. If a regulator can't find your risk disclosure within two clicks, the structure has failed.

Step 3. Build Compliance and Legal Pages from Day One

Compliance content is a non-negotiable component of broker website architecture, not a legal checkbox to address after launch. Missing or poorly written compliance pages on a broker website are the single most common reason licensing applications get delayed.

Every brokerage website needs the following pages at a minimum:

Risk Disclosure: not just a generic warning, but a statement that actually reflects the instruments you offer and the leverage involved.

Terms & Conditions: the document that governs the relationship between your brokerage and its clients. It should be complete, not copy-pasted from some template.

Privacy Policy: includes data collection, storage, processing, and GDPR compliance, or, as the case may be, any regional equivalent applying to your jurisdiction.

AML & KYC Policy: describing clearly the respective anti-money laundering procedure, and the verification requirements for the client's identity in a way that clients and auditors can understand.

Licensing/Regulatory Information: Provide the license numbers, regulatory body names, and applicable jurisdictions in a clear manner.

Regulators, banking partners, and liquidity providers actively review website content during due diligence. The FCA, CySEC, ASIC, and FSCA each have different expectations for how brokerage website compliance information is presented.

A generic, template-generated privacy policy will not satisfy a CySEC reviewer who expects specific references to MiFID II obligations. Missing or unclear compliance content can delay licensing applications by two to six months.

[aa fast-fact]

Compliance checkpoint: Pre-launch compliance costs only a small fraction of what it will eventually take to correct compliance issues identified by regulators. There are many ways, such as this one, by which specialized agencies far outperform general web designers who know little or nothing about financial regulation.

[/aa]

Step 4. Design for Trust: UX That Converts Traders

First impressions on a broker website are formed faster than most people realize — 50 milliseconds, according to research from CXL and the Missouri University of Science and Technology. That's not enough time to read a headline. Barely enough time to register that a page has loaded.

Which means design quality isn't a branding question. It's a credibility question. Traders decide whether a brokerage looks legitimate before they've read a single word.

The UX and design principles that matter most for broker website design come down to a fairly short list — but each one has a direct impact on conversion.

Clarity: users should immediately understand who the broker is serving and what the broker is offering, without needing to scroll to find out.

Professional design: clean and uncluttered design, consistent branding, and care taken in typography and images

Performance: fast loading is essential; a Portent study analyzing over 100 million page views found that a site loading in one second converts at a rate three times higher than a site loading in five seconds.

Security signals: visible SSL encryption, data protection indicators, and regulation badges, placed in the places traders tend to look.

Mobile-first design: a significant share of trading traffic arrives on mobile devices. Poor mobile UX isn't just bad for user experience; it leads directly to abandoned registrations.

Trust signals placement: testimonials, regulatory badges, security icons, and partner logos must also be prominently placed where the decision is made, i.e., other than just the homepage.

Conversion-focused layout: clear CTAs, logical user flow from landing page to registration, and low friction at each stage.

These are not cosmetic decisions. Each one directly affects time on site, bounce rate, and registration conversion. In an industry where traders compare multiple brokers before committing capital, the quality of forex broker website design often matters more than the underlying technology stack.

A poor mobile experience is particularly problematic. A Hostinger technology report found that sites which take more than two seconds to load will lose up to 60% of their audience. This is particularly problematic for brokers who invest heavily in acquiring customers through paid search or affiliate traffic.

Step 5. Choose the Right Platform for Your Broker Website

The platform selection is significant in terms of speed of entry, flexibility of design, and the extent of in-house resources needed to maintain the website in the long term. It is one of the most important considerations in the development of forex broker websites, as it is vital and has implications in almost all areas.

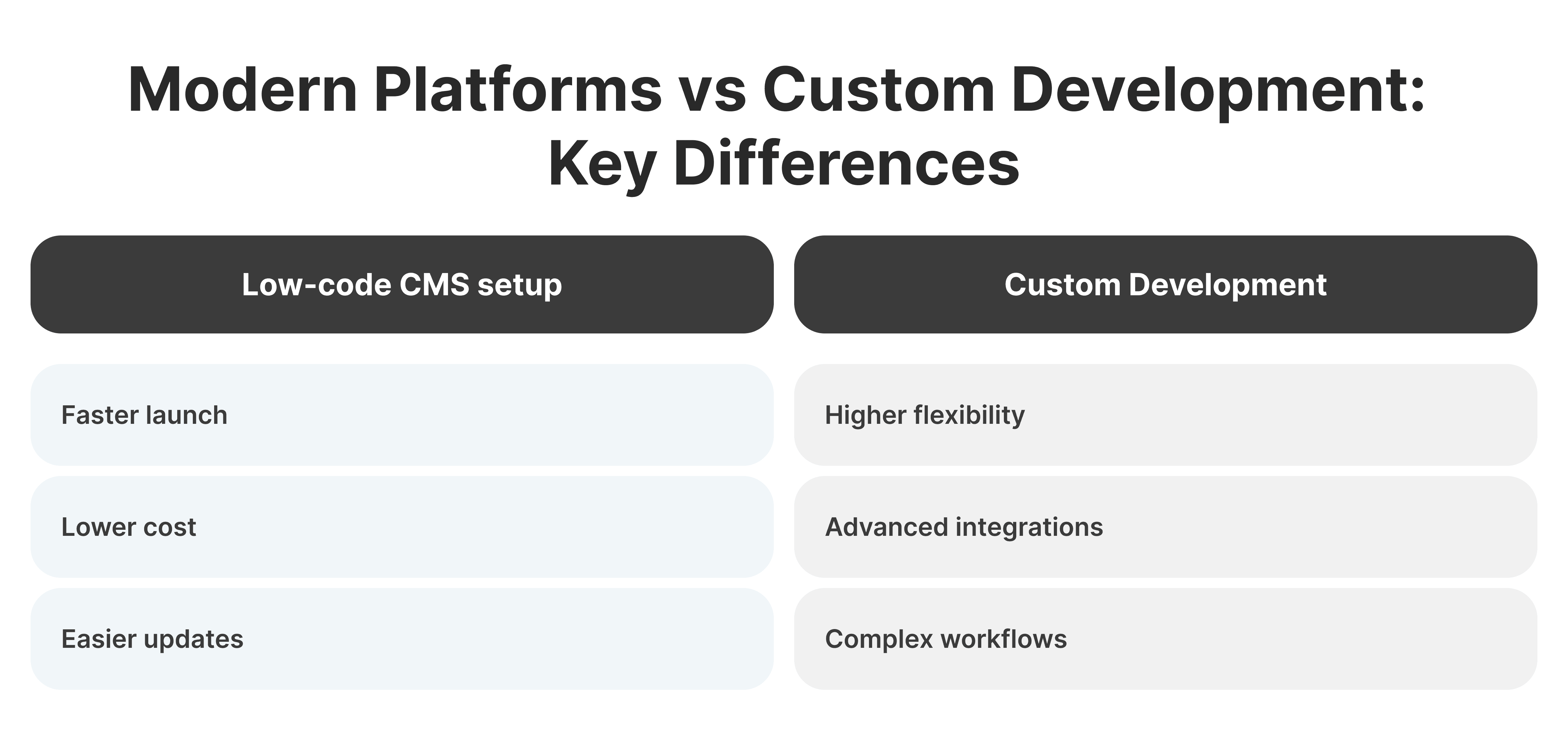

Modern No-Code/Low-Code Platforms (Framer, Webflow)

For most new and mid-sized brokerages, the best platform for broker website projects is a modern no-code or low-code tool like Framer or Webflow. Key advantages include:

Faster time to market: A professional Forex broker website development process has a faster development cycle, which takes between 4-8 weeks, while for a specially developed site, it could take between 3-6 months.

Design freedom without coding constraints: Both platforms offer the promise of pixel-level precision when it comes to designing, enabling users to create high-end visual effects for layouts, animations, and responsive designs for varying devices without undergoing complex coding techniques.

Built-in performance optimization: Features such as global CDN delivery, image optimization, and neat code generation can ensure that page loading speed is quite robust, thereby improving position on search engines.

Easy content updates: It allows marketing teams to easily make changes, swap out images, and update blog posts.

Integration capabilities: Both support CRM connections, analytics tools, form handlers, and third-party embeds.

When Custom Solutions Are Needed

For advanced functionality, such as custom trading dashboards, complex KYC workflows, or proprietary integrations, modern platforms can be extended with custom code. A hybrid approach often works best: speed for standard features, customization where unique requirements demand it. This hybrid model has become the standard in modern forex broker website design.

CMS and Hosting Considerations

Webflow offers more extensive CMS capabilities, making it strong for brokerages planning heavy content strategies. Framer excels at interactive design and micro-animations. WordPress should only be considered if blog-heavy extensibility is the absolute priority, but even then, the security overhead and plugin management make it a weaker broker website platform choice for modern financial services.

Both Framer and Webflow are far superior to WordPress for modern broker websites in terms of design flexibility and performance.

Step 6. Set Up Integrations, SEO, and Growth Infrastructure

Even at launch, a brokerage website should be wired for scaling, not retrofitted after the fact. The difference between a site that generates measurable ROI and one that sits idle often comes down to what gets configured before go-live.

Essential Integrations from Day One

CRM-connected forms: Every lead capture point should feed directly into the brokerage website's CRM. Manual lead management does not scale.

GA4 and GTM event tracking: Configure your analytics solution to track micro-conversions, which can include form starts, CTA button clicks, platform downloads, and demo account activations.

Live chat: Traders expect instant support. A live chat widget can greatly reduce bounce rates and capture leads that would normally be lost.

Email marketing and lead capture: Newsletters sign-ups, content downloads, and email sequencing shall all be fully functional from the first day.

Trading platform links: Deep links to MT4, MT5, cTrader, or web trader should be featured and tested across all devices.

SEO and Content Strategy

For starters, broker website SEO is not something to add later. Architecture decisions, like those that go into building a website, are decisions that are taken before the site is launched, including URL structure, headings, internal links, structured data, and speed, which can significantly affect the rate at which a site achieves organic search traffic.

A content-centric approach to SEO should include keyword research pertaining to brokerage topics, a blog content publishing schedule, an education section optimized for long-tail query terms, and a glossary to catch informational query types. With GEO (Generative Engine Optimization) increasingly being an important entity, well-structured content becomes even more important for search engines to utilize AI.

Multilanguage and Localization

A multilingual broker website is vital for different brokerages servicing numerous locations. Modern websites manage multilingual content through subfolders or subdomains, but it is necessary to include hreflang tags, content, and culturally appropriate metadata, not simply translated content.

Analytics and Conversion Tracking

Analytics must be configured and tested before launch. Without baseline data from day one, the brokerage website has no way to measure ROI, identify drop-off points, or optimize conversion paths.

DIY Templates vs. Professional Broker Website Design

The template-versus-custom decision is one of the most consequential choices a brokerage founder makes, and it is frequently misunderstood. The real question behind the broker website template vs custom debate is not about upfront cost. It is about what happens six to twelve months after launch.

A DIY template can work if you have:

Simple requirements without complex compliance needs across multiple jurisdictions

Internal design and content expertise to customize extensively

Time to learn the platform and iterate through multiple revisions

Willingness to accept a generic design that competitors may also be using

Working with a specialist makes sense when:

You need a unique brand identity that differentiates you in a crowded market

Compliance requirements are complex or jurisdiction-specific (FCA, CySEC, ASIC, FSCA)

You want optimized conversion paths based on trader behavior data

Time to market is critical and costly mistakes would set you back months

You need integrations with CRM, KYC systems, or trading platforms

SEO and performance need to be embedded from day one

A generic broker website template saves money initially but often requires so much customization to meet broker-specific needs that the total cost exceeds professional fintech website design. The difference becomes painfully clear during regulatory reviews or when comparing registration conversion rates against competitors who invested in purpose-built broker website design.

Most templates also produce identical forex web design across multiple brokerages, which undermines credibility in an industry where differentiation is critical to earning trader trust.

Common Mistakes When Creating a Broker Website

Even experienced teams stumble on predictable pitfalls. Here are the most frequent errors when building a forex broker website:

Prioritizing aesthetics over conversion optimization — A visually striking website that doesn't guide users toward registration is an expensive art project.

Ignoring compliance requirements until late stages — This single mistake causes two-to-six-month licensing delays and forces costly last-minute content overhauls.

Poor mobile experience despite mobile-first traffic — Over 55% of forex traders now prefer mobile devices. A desktop-only mindset is outdated.

Using generic stock images and template content — These undermine credibility in an industry where trust is the primary currency.

Launching without analytics — If you cannot measure it, you cannot improve it.

Treating the website as a one-time project —The brokerage website is a live business property that demands continuous content maintenance, performance monitoring, and optimization.

A visually attractive website without clear user pathways and proper compliance often becomes an expensive liability rather than a growth asset.

Pre-Launch Checklist: Things to Verify Before Going Live

A structured pre-launch review separates professional broker website launches from avoidable post-launch crises. Use this broker website launch checklist as a quality gate before going live:

Content and design review complete, including accuracy of compliance information for all targeted jurisdictions

Functional tests across various devices like mobile, tablet, and desktop, and browsers like Google Chrome, Safari, Firefox, Edge, etc

Page speed and performance benchmarking. Targeting sub-2-second page loads on desktop devices

SSL Certificate is installed, and all pages are served over HTTPS.

GA4 and GTM are configured, tested, and generating data correctly

All forms, CTAs, and lead capture flows are working end-to-end

SEO basics are set up, including meta tags, structured data, and XML sitemap submission, and robots.txt has been verified.

Multilingual content reviewed by native speakers (if applicable)

Backup and disaster recovery procedures are documented and tested

Skipping this list means finding broken forms, missing analytics, or compliance issues just as your first wave of visitors is bouncing in.

Why Fintech-Specialized Partners Deliver Better Results

Most successful brokers work with agencies that specialize in financial services rather than generalist web designers. Fintech website design specialists bring deep understanding of regulatory requirements across multiple jurisdictions, conversion patterns specific to trading platforms, the ability to structure content for both compliance and conversion simultaneously, and experience with the CRM, KYC, and analytics integrations that brokerages need from day one.

Before committing to any partner, consider these steps:

Review examples of broker websites in your target market and jurisdiction

Understand compliance requirements for your specific regulators (FCA, CySEC, ASIC)

Identify key conversion points in your trader journey

Evaluate if speed to market or extensive customization is more important

WSA specializes in creating high-performance websites for Forex brokers, fintech companies, and trading websites. They provide fintech UX and content expertise, scope definition from the first day, rapid development (launching in weeks, not months), as well as SEO and GEO optimization, and support. They can assist brokerages in launching high-performance websites that attract traders while satisfying regulators. Explore real broker website projects to see the work firsthand.

Build a Broker Website That Converts Traders and Satisfies Regulators

From startup brokerages to established platforms, WSA delivers websites that convert traders, satisfy regulators, and scale across markets.

Frequently Asked Questions about Creating a Broker Website

How long does it take to create a broker website?

With platforms like Webflow or Framer, the usual duration required to create a professional broker website from concept to launch is 4 to 8 weeks; this includes design, compliance review, content integration, and testing. In contrast, traditional custom development typically takes at least 3–6 months, and often longer.

Can I use a template for my forex broker website?

Templates can work to test a market or very early-stage operations, but rarely meet compliance, branding, and conversion requirements that regulated brokers need. Most templates need extensive adjustments, which often take longer and are more expensive than starting with professional design. On top of that, using the same template as your competitors undermines your credibility.

What do regulators review on broker websites?

Regulators review risk disclosures, fee transparency, licensing information, statement of terms in a clear manner, and freedom from misleading claims. They also check that client protection policies are conspicuously displayed. Many brokers find compliance gaps when submitting applications for a license-issues that could have been avoided with the right planning. Requirements vary by regulator (FCA, CySEC, ASIC, FSCA).

How much does a professional broker website cost?

Professional broker websites, such as the ones developed on platforms like Webflow or Framer, can range between $5,000 or $25,000, depending on the complexity, integration, or regulatory requirements. The process is much quicker and more affordable, as traditional custom development can cost over $30,000–$100,000+, yet yields a similar product. Clearly defining scope upfront is the best way to control broker website cost.

What platform is best for a broker website?

Webflow and Framer are industry standards for professional broker websites and provide flexibility with design, performance, SEO, and integration with critical services. The decision to use one or the other will depend upon specific requirements; Webflow provides far better CMS options, and Framer is best used for interactive design and animations. Both options are better compared to WordPress, especially when building modern broker websites.

Should I hire a general designer or a fintech specialist?

While general designers often have difficulty with broker-specific requirements such as regulation, financial service credibility indicators, trader psychology, and conversion optimization for high-value users, specialists understand regulation demands, trader psychology, credibility indicators, and conversion optimization. The distinction is immediately apparent during regulatory review or when discussing conversion rate disparities. Most successful brokers work with agencies that specialize in fintech website design.

What is the biggest mistake brokers make with their websites?

Considering this website as a one-time project, as opposed to a strategic investment. The forex broker website will affect first impressions, approval schedules, partnership credibility, and conversion rates for many years to come. Cutting corners on the cheapest solution or quickest solution versus quality usually requires costly redesigns within 12-18 months. Starting with professional design and proper platform selection will one day pay for itself with better conversions and fewer delays.

Whether you’re launching something new or improving an existing platform, we’re ready to discuss your goals and explore the best way forward.