•

•

A broker website redesign can drive significant growth, or cause serious damage. A poorly executed redesign will negate months of SEO optimization, destroy compliance infrastructure, and shatter conversion paths that have taken years to optimize. When done strategically, they transform underperforming digital infrastructure into a competitive advantage that generates more qualified leads while maintaining regulatory credibility.

A poorly executed redesign will negate months of SEO optimization, destroy compliance infrastructure, and shatter conversion paths that have taken years to optimize. A well-executed redesign will transform a weak digital infrastructure into a potent differentiator that generates more qualified leads while maintaining regulatory integrity.

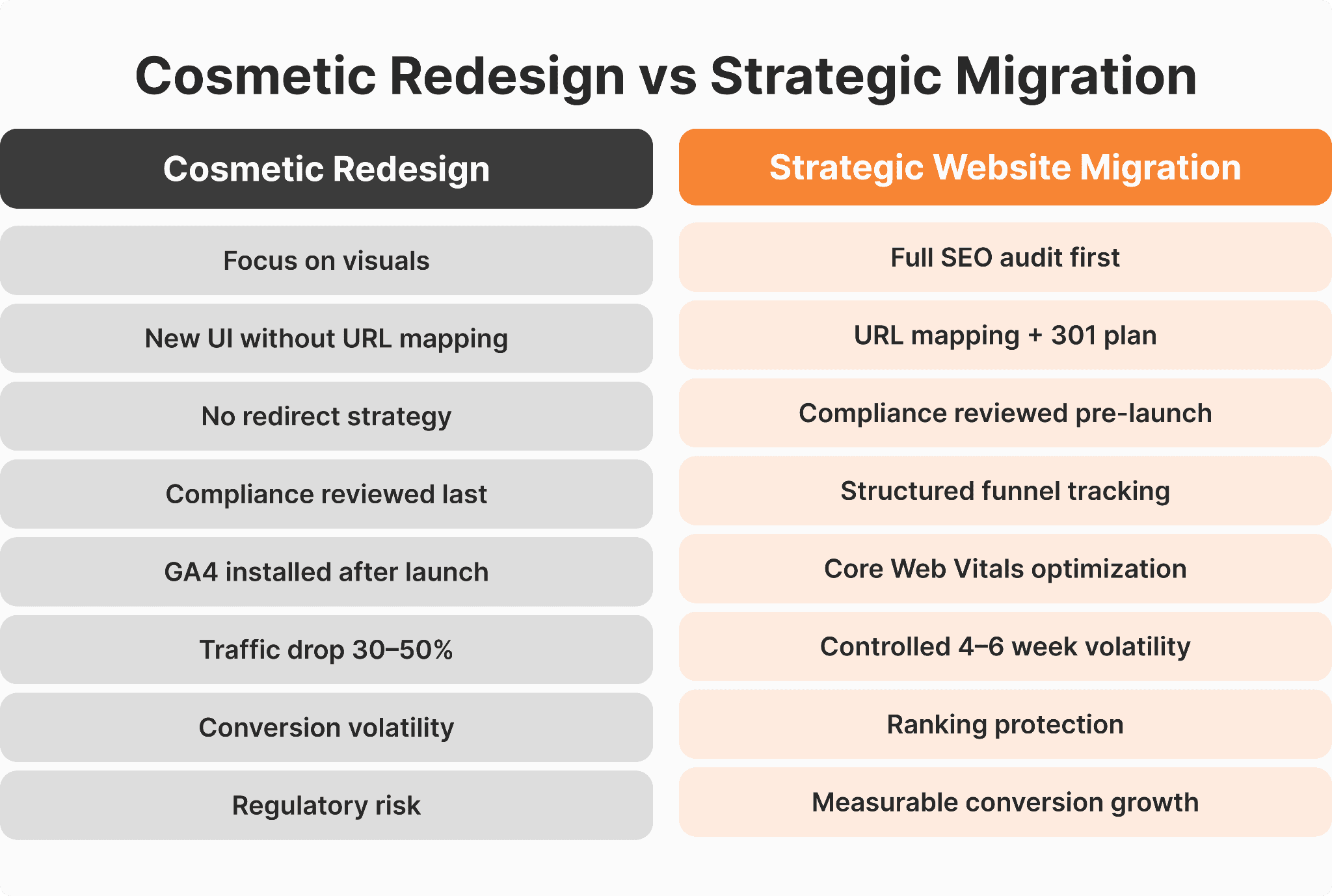

Most brokerages approach redesigns as visual refreshes. They focus on modernizing aesthetics while overlooking the technical, regulatory, and performance layers that actually drive results. This creates predictable failures: according to Search Engine Journal's migration research, organic traffic drops by 30-50% post-launch when proper protocols aren't followed, compliance teams discover missing disclosures weeks after going live, and registration conversion rates decline despite the "improved" user experience.

This website migration checklist acknowledges your brokerage website for what it is—a regulated, revenue-generating infrastructure asset that must preserve existing value while creating new opportunities for growth.

Key Takeaways

A broker website redesign must preserve existing SEO signals before redesigning or restructuring the site—record all URLs, rankings, and backlinks during the audit phase

Compliance and legal pages must be reviewed first, not added after redesign, since regulators review website content during licensing reviews

UX improvements directly influence registration rates and regulatory credibility through trust signals, load speed, and mobile performance

Redirect strategy and technical SEO audits prevent traffic loss during the 4-6 week post-launch volatility period

A high-converting broker website requires structured conversion paths and measurable funnel tracking, not just modern visuals

Why Broker Website Redesigns Often Fail

Redesign failures follow predictable patterns. The most common cause is treating migration as a design project rather than a technical business migration that requires systematic risk management.

Traffic drops occur when redirect strategies are incomplete.

A forex broker moving from /trading-platforms.php to /platforms without implementing proper 301 redirects will result in the loss of all the accumulated link equity from the URL. When this happens on dozens or hundreds of pages, organic visibility will collapse. Google will consider the pages as deleted content and will remove them from search results within weeks.

Broken internal linking destroys site architecture.

Brokerages often rebuild navigation without mapping how pages connect to each other. A previously well-linked "Account Types" page becomes orphaned in the new structure, losing its ranking power.

Compliance pages get removed or restructured improperly.

When redesigning, marketing departments focus on image-rich pages and consider risk disclosures and privacy policies as an afterthought. These pages are often launched with outdated terms, lacking jurisdiction-specific disclaimers or functional links to official documents.

UX changes disrupt onboarding flows.

A broker could optimize their registration page by splitting it into a multi-step process, inadvertently increasing the abandonment rate from 60% to 85%. They won't even notice this error for weeks, after blowing hundreds of potential customers, because they lack proper analytics

Frame your redesign so that you don't lose search rankings as a business-critical site migration, not a facelift.

Step 1. Perform a Full SEO Audit Before Redesign

Never start redesigning without first documenting your existing SEO value. This SEO audit will give you your baseline to measure success and what needs to be maintained during the migration process.

Begin by crawling your current site to create a full URL inventory. Tools such as Screaming Frog or Sitebulb will assist you in determining all pages, their status codes, and how they are interconnected with each other through internal linking. This information will then be exported into a URL mapping spreadsheet that will guide your redirect strategy.

Identify your top-performing pages by analyzing:

Pages driving the most organic traffic (Google Analytics 4 or Search Console)

Landing pages with the highest conversion rates

Content ranking in positions 1-10 for target keywords

Pages with the strongest backlink profiles

Historical content that maintains steady traffic

Map current keyword rankings for your primary terms. Document which pages rank for "forex broker," "CFD trading platform," "MetaTrader 5 broker," and similar commercial keywords in your niche.

Pre-redesign audit checklist:

Complete URL inventory exported

Top 50 landing pages identified with traffic data

Total indexed pages verified in Google Search Console

XML sitemap downloaded and validated

Core Web Vitals baseline recorded for key pages

Backlink profile exported with source URLs

Keyword ranking positions documented for 50+ target terms

Current conversion rates recorded by page and traffic source

This audit typically requires 8-15 hours for a mid-sized brokerage website (100-300 pages). The investment prevents traffic losses that cost far more in lost lead generation.

Step 2. Preserve and Improve Your Broker Website Structure

Your URL structure represents accumulated SEO equity that search engines have spent months or years understanding. Strategic fintech web development maintains this equity while improving logical organization for users and regulators.

Maintain the URL structure that search engines already trust. If the existing high-ranking page is /trading-platforms/metatrader-5, the new URL structure should either keep this URL or create a clear 301 redirect to a similar URL such as /platforms/mt5. Do not be tempted to refactor URLs purely for cosmetic reasons, as each new URL introduces new risk.

Essential pages for a complete brokerage website structure:

Core Pages:

Homepage (clear value proposition and regulation badges above fold)

Trading Instruments (Forex, CFDs, Commodities, Indices, Crypto where licensed)

Trading Platforms (MT4, MT5, cTrader, proprietary platforms)

Account Types (Demo, Standard, ECN, Prime, Islamic where offered)

Fees & Trading Conditions (spreads, commissions, swaps, margin requirements)

Compliance & Trust:

Regulation & Licensing (license numbers, regulatory bodies, authorization scope)

Risk Disclosure

Terms & Conditions

Privacy Policy

AML/KYC Policies

Growth & Education:

Blog (industry insights, platform tutorials, market commentary)

Partner/IB Program

Conversion Pages:

Contact & Support

Account Opening/Registration

Client Portal Login

This is very useful for SEO reasons, as it helps to create topic authority clusters, for UX reasons, as it helps to create predictable navigation patterns, and for regulatory purposes, as it demonstrates comprehensive disclosure.

Step 3. Rebuild Compliance Pages With Regulatory Precision

Compliance pages are a vital part of infrastructure that is viewed by regulators, banking partners, and institutional clients as part of due diligence. The FCA's financial promotion guidance emphasizes the need for the content of the website to be clear, fair, and not misleading, which is relevant throughout the entire life cycle of the website, including redesigns.

Required compliance documentation for regulated brokers:

Risk Disclosure: Clear explanation of trading risks, potential for loss exceeding deposits, and suitability warnings. Must be prominently accessible from homepage and before account registration. FCA requires specific language about 76-80% of retail CFD accounts losing money. CySEC rdemands similar disclosures in the first official language of each client’s country.

Terms & Conditions: Full legal agreement on account opening, trading terms, corporate actions, dispute resolution, and limitation of liability.

Privacy Policy: GDPR-compliant explanation of data collection, processing, storage, sharing, and client rights.

Compliance integration checklist:

Legal team review of all compliance page content before staging launch

Regulatory consultant sign-off where required by license conditions

Links to regulatory bodies tested and verified

Risk warnings visible on homepage

Compliance pages accessible from footer on every site page

Regulators review website content during initial licensing applications, ongoing supervision, and renewal processes. Content that doesn't meet regulatory standards can result in license conditions or public warnings.

Planning a redesign but concerned about SEO and compliance risks?

WSA specializes in regulated broker website migration that preserves rankings while improving conversion performance.

Step 4. Upgrade UX to Improve Conversion Rates

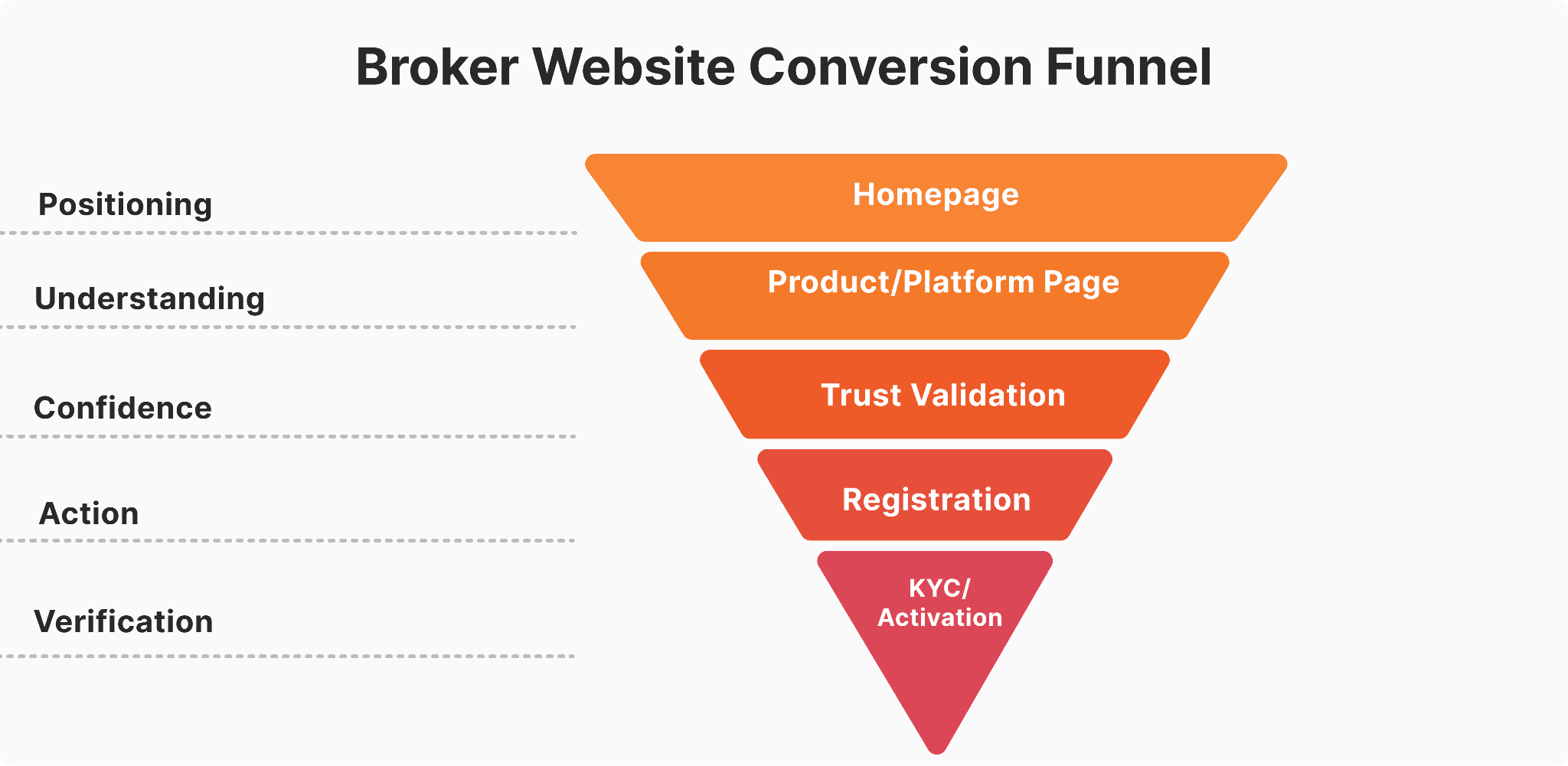

User experience decisions directly impact registration rates, account funding rates, and client lifetime value. Strategic UX improvements create measurable revenue increases through high-converting broker website architecture.

First impression effect has a 3-5 second timeline. When a potential trader lands on your homepage, they immediately evaluate the relevance and value proposition. Optimize the experience above the fold to immediately convey: what you have to offer (trading products and platforms), why you are credible (regulatory badges and licenses), and what they should do.

Trust signals must be immediately visible. Regulatory badges, licenses, and security seals should be placed in the header or hero section. A CySEC-licensed broker should prominently display their CIF number. An FCA-regulated broker should display FCA registration in the top navigation.

Simplify the registration flow by removing friction:

Reduce initial registration to email, password, country (3 fields)

Defer detailed KYC information until after initial account creation

Implement progress indicators for multi-step processes

Enable social login options where regulations permit

Auto-fill address fields from postal code lookups

Mobile-first performance is not optional. Based on Google’s research on mobile speed, 53% of mobile site visits are abandoned if pages take longer than 3 seconds to load. Over 65% of brokerage site traffic comes from mobile. The goal is to have load times of less than 2-3 seconds for important pages. According to research by Portent, the conversion rate for websites will drop by an average of 4.42% for every second of load time between seconds 0-5.

Use Google PageSpeed Insights to test current performance and see where optimization is needed.

Connect UX improvements to measurable conversion metrics:

Bounce rate reduction from 68% to 45% through improved first impression

Registration completion rate increase from 28% to 52% through simplified forms

Mobile conversion rate increase from 1.2% to 2.8% through responsive optimization

Cost per acquisition decrease from $340 to $185 through higher conversion rates

Step 5. Set Up Redirects and SEO Safeguards

This is the most critical technical phase of any brokerage web development project. According to Google's migration documentation, mistakes during site migrations can cause permanent SEO damage that takes 12-18 months to recover from.

301 redirects must be implemented for every changed URL. Create a comprehensive redirect map during your SEO audit that documents:

Old URL → New URL

Redirect type (301 permanent redirect)

Verification status (tested and confirmed working)

Every page that changes URL requires a redirect. Every deleted page should redirect to the most relevant existing page. Never have pages return 404 errors if they have ranked in the past or had backlinks.

Submit your XML sitemap to Google Search Consoles soon as your site is launched. The new sitemap should contain all live pages, correct priority values for key pages, correct lastmod dates, and no redirects or broken links in the sitemap

Verify canonical tags are properly implemented. Each page should have a canonical link to itself or to the preferred version of any duplicate content.

Expect a 4-6 week volatility period post-launch. Even a flawless launch will cause temporary fluctuations in rankings as search engines recrawl your site. During this period:

Rankings may fluctuate 5-10 positions for target keywords

Some pages may temporarily drop out of top 100 before recovering

Traffic may dip 10-20% before stabilizing

This volatility is normal. The key is distinguishing between normal fluctuation and serious problems requiring immediate fixes.

Post-launch SEO monitoring checklist:

All redirects tested and confirmed working

Updated sitemap submitted to Search Console

Robots.txt validated and confirmed correct

Canonical tags verified on key pages

Search Console monitored daily for two weeks

Ranking positions tracked weekly for 8 weeks

Traffic compared to pre-launch baseline weekly

Step 6. Strengthen Analytics and Conversion Tracking

Redesign creates the opportunity to fix tracking gaps that have prevented accurate performance measurement. Proper analytics implementation turns your website from a cost center into a measurable revenue channel.

Google Analytics 4 configuration must be completed before launch, not after. GA4 requires different setup than Universal Analytics and doesn't automatically track the events most relevant to brokerages:

Form submissions (registration, contact, download)

Button clicks (Demo account, Live account, Contact sales)

Scroll depth on key pages

File downloads (platform guides, fee schedules)

Event tracking should measure the complete conversion funnel:

Landing page visit

Product page engagement

Registration form started

Registration form completed

Email verification completed

Account opening completed (KYC submitted)

Account funded

First trade placed

Each stage represents a potential drop-off point. Tracking each event identifies where prospects abandon the funnel and where optimization efforts should focus. If you're experiencing issues with low broker website conversion rates, proper funnel tracking reveals exactly where prospects drop off and which optimization efforts will have the greatest impact.

Create custom dashboards showing the metrics that matter: registration conversion rate by traffic source, cost per acquired client, and revenue per marketing channel.

Common Mistakes During Broker Website Redesign

Avoid these predictable failures that cause most redesign projects to underperform:

Changing URLs without redirect mapping. The most common and most damaging mistake. Creates immediate traffic loss as search engines find broken pages and remove them from results.

Removing compliance disclosures to "clean up" the design. Marketing teams often see legal pages as clutter and try to hide or remove them. This creates regulatory liability and undermines institutional credibility.

Launching without analytics validation. Teams assume tracking will "just work" and discover weeks later that conversions aren't being recorded.

Ignoring mobile UX. Designing desktop-first and treating mobile as an afterthought. With 65%+ of traffic on mobile, mobile experience should be the primary design focus.

Treating redesign as a purely visual project. This involves focusing only on the visual aspects of the project while overlooking the technical and SEO aspects of the project.

All the above mistakes have one thing in common: they treat redesign as a marketing project and not as a technical business migration that involves risk management.

Rebuilding without a specialized partner increases risk exponentially.

As a fintech website agency, WSA has developed proven frameworks that preserve rankings while delivering measurable conversion improvements. We handle the complete migration—from compliance review to post-launch monitoring. Explore our approach: View Broker Website Projects

Broker Website Redesign Checklist (Printable Summary)

Use this condensed website migration checklist to ensure comprehensive coverage:

Pre-Redesign

Complete SEO audit with URL inventory

URL mapping spreadsheet created

Traffic and conversion benchmarks documented

Keyword rankings exported

Backlink profile exported

Compliance content reviewed by legal team

During Redesign

URL structure preserved or redirect map completed

UX improvements designed with conversion data

Mobile-first design implemented

Core Web Vitals optimization completed

GA4 and GTM tracking configured

Compliance pages rebuilt with regulatory precision

Pre-Launch

All 301 redirects tested in staging

SEO crawl of staging site completed

Compliance sign-off obtained

Page speed benchmarked on key pages

Analytics tracking verified with test transactions

Post-Launch

Rankings monitored weekly for 8 weeks

Search Console monitored daily for crawl errors

Traffic compared to baseline weekly

Conversion data analyzed

Optimization roadmap created based on early data

Frequently Asked Questions

How long does it take to redesign a broker website?

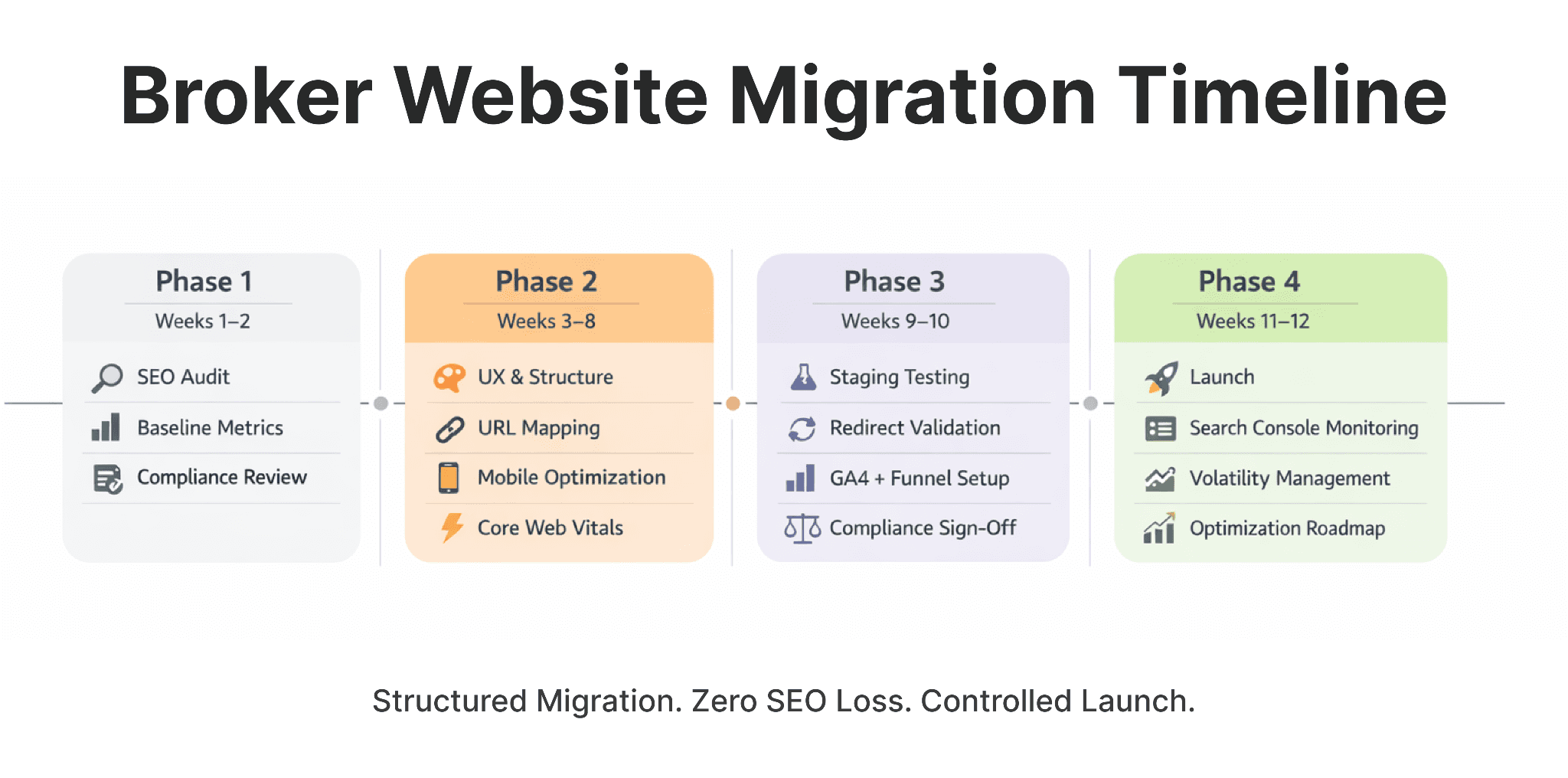

A full fintech website rebuild will require 8-16 weeks, depending on the complexity of the website, regulatory requirements, and stakeholder coordination. This will include: 2 weeks for audit and planning, 4-8 weeks for design and development, 1-2 weeks for regulatory review, and 1-2 weeks for testing and launch preparation. Anything less will likely cause damage to SEO, regulatory compliance, or conversion rates.

Will my website traffic decrease during a redesign?

It is to be expected that there will be some fluctuation in your website traffic even with a perfect website redesign. You can expect a 4-6 week period of turbulence in which your rankings may change 5-10 spots as the search engines re-index your website. Your traffic will probably drop 10-20% during this period, but if this continues, you probably have a technical problem, such as unmapped redirects or broken internal links.

Do I need to redesign my whole website or can I do it in phases?

While phased redesigns can be done on very large websites, they need to be done very carefully. The best way to do a redesign is to do it by section: begin with low-traffic support pages, followed by high-traffic commercial pages, and finally redesign compliance and account opening pages. For most brokerages with 50-300 pages, a full redesign without losing search engine rankings done correctly will produce better outcomes than phased redesigns over an extended period of time.

How do I know if my current website actually needs a redesign?

A redesign is necessary if you can point to specific issues: conversion rates well below industry averages (2-4% for demo accounts, 0.5-1% for live accounts), page load times over 4-5 seconds, mobile traffic with 70%+ bounce rates, or non-compliant compliance pages. See more about diagnosing conversion issues on broker websites. A redesign is not necessary if your website "looks old." Begin with data to determine what is underperforming.

Should I hire an agency or can my internal team handle the redesign?

This depends on your team's expertise in fintech web development, regulatory compliance, and technical SEO migration. Internal teams can handle redesigns if they have: experience with FCA/CySEC/ASIC compliance requirements, proven expertise in technical SEO migration with 301 redirects, knowledge of trading platform integrations, and dedicated capacity for 8-16 weeks. Most brokerages lack this combination, making specialized agencies the lower-risk option. Review the key differences in our guide comparing fintech web design agencies vs generic web studios.

Whether you’re launching something new or improving an existing platform, we’re ready to discuss your goals and explore the best way forward.