•

•

In 2026, brokerage website development is no longer just a design project.

For regulated forex brokers, CFD brokers, and multi-asset trading firms, a website functions simultaneously as:

Regulatory infrastructure

Client acquisition engine

Due diligence surface

Operational integration layer

It shapes:

How regulators evaluate your governance

How traders assess your legitimacy

How efficiently traffic converts into funded accounts

How cleanly CRM, KYC, and trading systems operate together

Brokers who treat their website as a marketing brochure often rebuild within 12–18 months. Brokers who treat it as infrastructure tend to scale without structural disruption.

In competitive trading markets, structure signals seriousness.

This guide outlines what regulated brokerage websites must address in 2026 across compliance, UX, performance, integration, multilingual architecture, and AI-driven search visibility.

Key Takeaways

Brokerage website development in 2026 is operational infrastructure—not decoration

Compliance hierarchy must be embedded structurally from day one

Trust-driven UX directly impacts registration quality and funded account growth

Performance influences SEO rankings, paid media efficiency, and CPA

MT4, MT5, and cTrader integration must be engineered before launch

Multilingual and multi-jurisdiction architecture is baseline for regulated brokers

Strategic planning prevents costly rebuilds within 12–24 months

AI-driven search increasingly rewards structured, extractable content

What Is Brokerage Website Architecture?

Brokerage website architecture refers to the structural framework that governs how compliance, content, onboarding, and trading platform integrations operate together within a regulated financial environment.

Unlike generic corporate web design, broker website development must balance:

Regulatory disclosure obligations (FCA, CySEC, ASIC, FSCA, ESMA)

Cross-border communication requirements under MiFID II

Conversion-optimized UX for trader acquisition

MT4, MT5, or cTrader integration

CRM, KYC/AML, and payment gateway connectivity

Multilingual and multi-entity segmentation

A regulated broker website is not merely a marketing channel. It is a controlled financial communication system.

In forex and CFD markets, architecture becomes strategy.

1. Regulatory Architecture Is Structural — Not Cosmetic

Compliance cannot live in a footer.

Regulators increasingly review broker websites during licensing, renewals, and audits. They assess not only whether risk disclosures exist, but how clearly and structurally they are presented.

Typical evaluation criteria include:

Visibility of risk warnings

Clarity of leverage and margin communication

Transparency of spreads and commissions

Separation between licensed entities

Accuracy of marketing claims

Accessibility of legal documentation

Under MiFID II and ESMA-aligned frameworks, jurisdictional communication must precisely reflect authorization boundaries. Even technically compliant disclosures can raise concerns if buried deep within navigation.

Banks and liquidity providers also review websites during due diligence. Structural opacity can trigger operational red flags.

A properly engineered broker website typically includes:

Clear compliance hierarchy

Contextual, prominent risk disclosures

Jurisdiction-specific content segmentation

Accessible legal hubs

Explicit entity differentiation

Compliance failures rarely occur because information is missing. They occur because structure reduces clarity.

2. Trust-Driven UX Determines Funded Account Growth

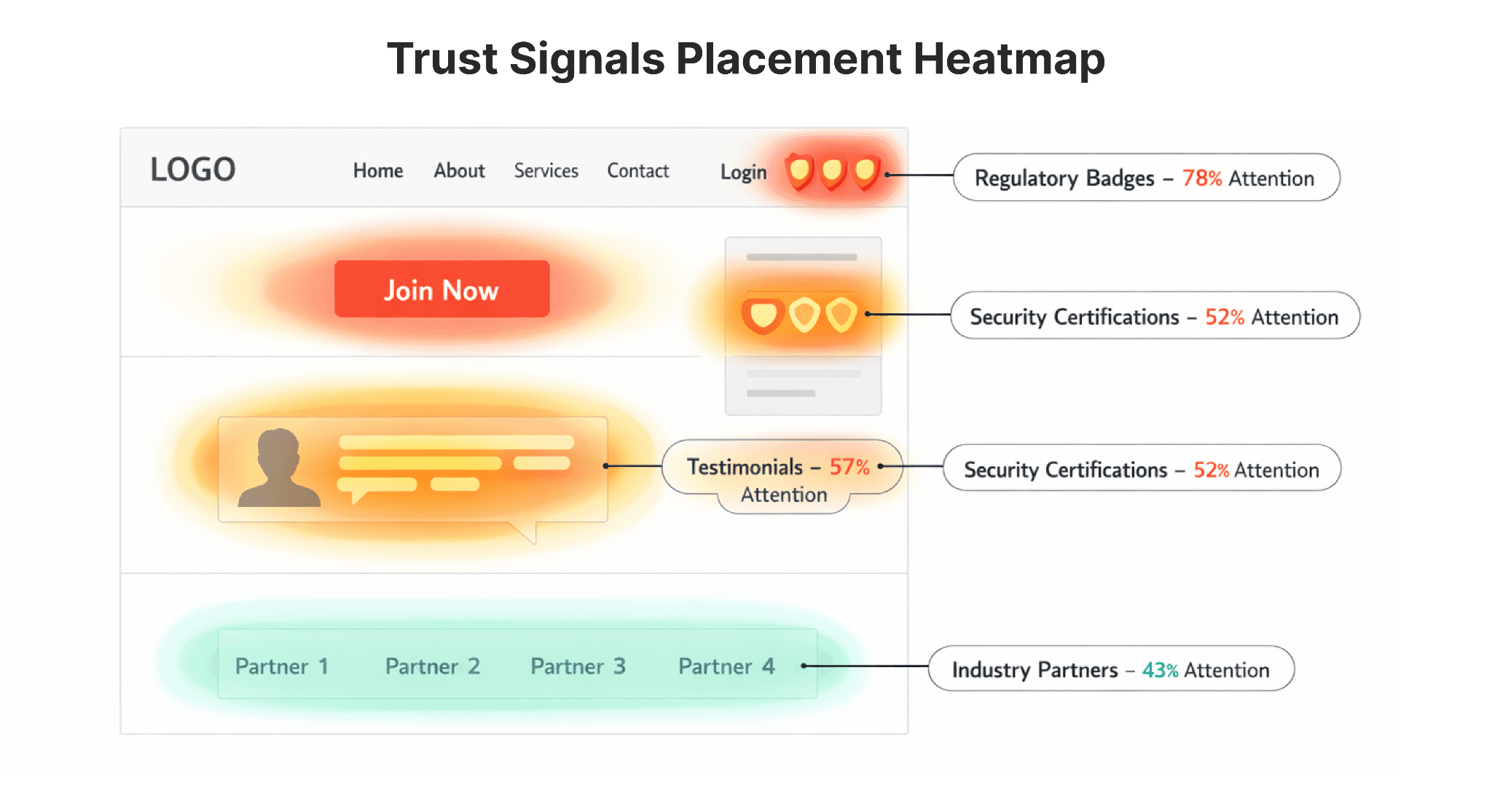

In trading environments, perceived legitimacy directly influences conversion.

Users form credibility judgments in milliseconds, according to research from the Nielsen Norman Group. If uncertainty outweighs clarity, onboarding stalls.

Common friction points on broker websites include:

Overloaded hero sections

Hidden or vague spread information

Confusing account comparison tables

Inconsistent regulatory positioning

Weak mobile optimization

Slow performance under peak traffic

Traders rarely abandon because a layout feels outdated. They abandon when risk perception rises.

High-performing brokerage websites prioritize:

Clear value proposition above the fold

Transparent spreads, leverage, and fee communication

Logical account comparison structures

Guided onboarding flows

Mobile-first responsiveness

Sub-2-second load times

Conversion architecture is less about visual polish and more about cognitive risk reduction.

3. Performance Directly Impacts SEO, Paid Media, and CPA

Performance is not just technical—it is financial.

Google's Core Web Vitals influence rankings, but speed also affects:

Bounce rate

Onboarding completion

Paid media Quality Score

Cost-per-acquisition

When funded accounts cost $400–$1,200 to acquire, a one-second delay becomes measurable revenue loss.

Modern brokerage websites should include:

Global CDN configuration

Optimized image formats (WebP, AVIF)

Clean front-end architecture

Deferred script loading

Stable layout rendering

Plugin-heavy systems often introduce volatility—particularly when integrating MT4/MT5 dashboards. Modern platforms like Webflow consistently deliver superior performance benchmarks.

In competitive markets, speed communicates reliability.

4. Trading Platform Integration Defines Operational Stability

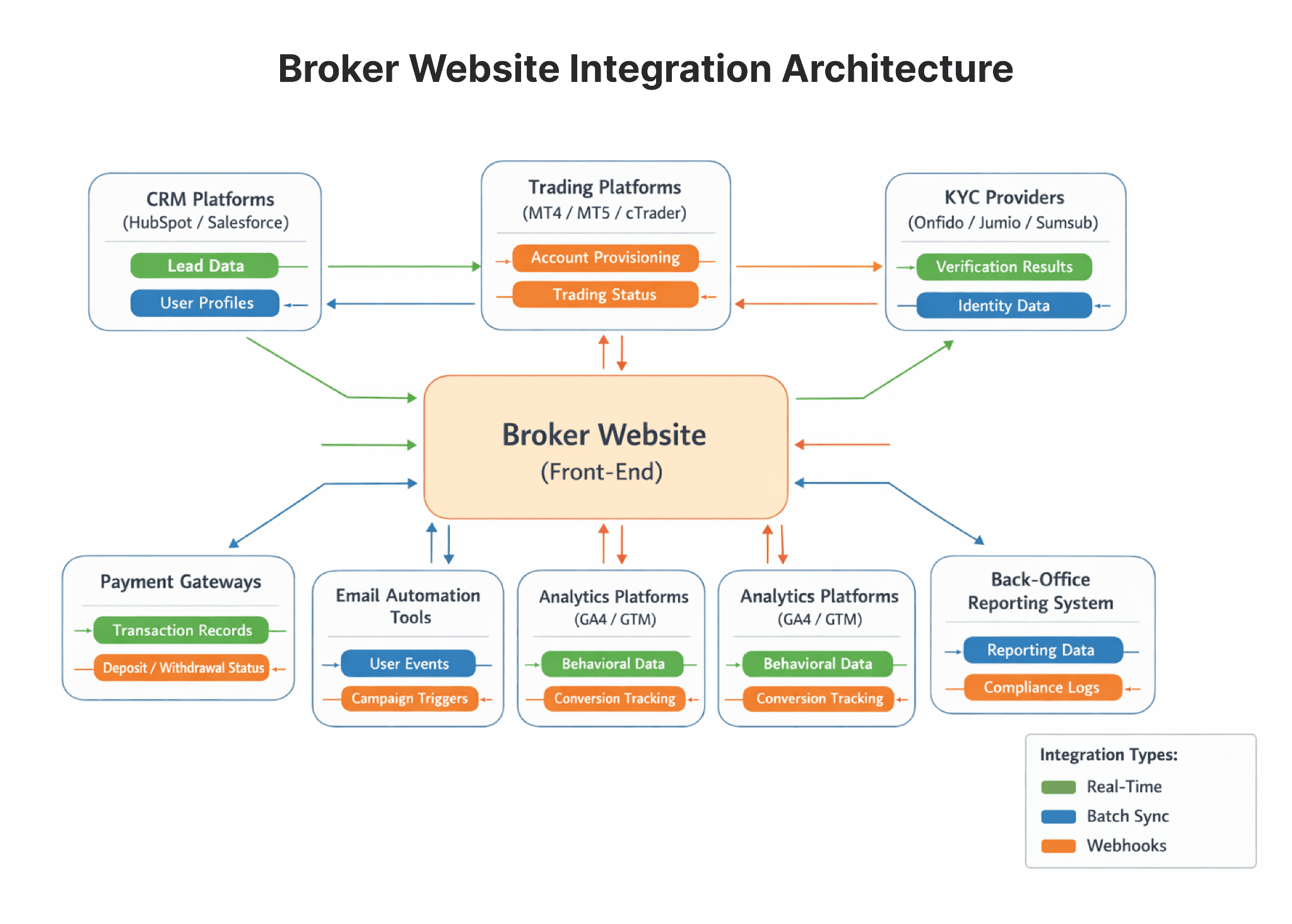

A website disconnected from trading infrastructure creates friction that compounds over time.

Broker websites often integrate with:

MetaTrader 4 (MT4)

MetaTrader 5 (MT5)

cTrader

Proprietary dashboards

These integrations must align with:

CRM synchronization (HubSpot, Salesforce, or proprietary systems)

KYC/AML workflows

Payment automation

Client authentication systems

Reporting and audit trails

When visual design is prioritized before integration logic, brokers frequently spend months reconciling CRM data and restructuring onboarding flows. Learn more about proper integration planning for broker websites.

Website structure should follow operational logic - not visual preference.

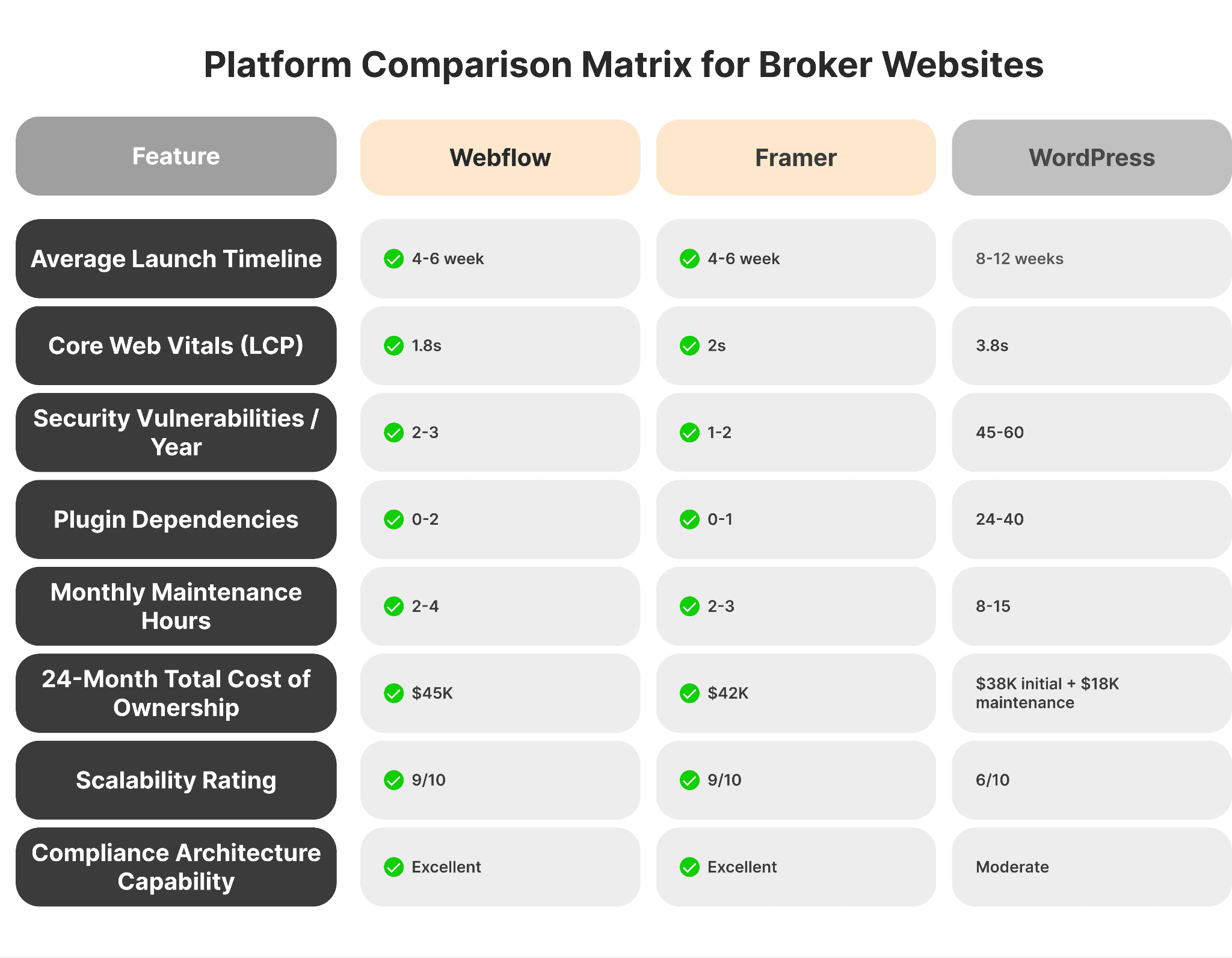

5. Platform Selection Shapes Long-Term Risk

The CMS or framework chosen defines scalability, security exposure, and performance stability.

Modern platforms such as Webflow and Framer provide:

Structured CMS control

Strong SEO capabilities

Faster deployment timelines (4–8 weeks typical)

Reduced plugin dependency

Built-in performance optimization

Automatic security updates

WordPress remains common but often introduces:

Ongoing security management

Plugin conflicts (25–40 plugins on average broker sites according to Sucuri)

Performance variability

Templates optimize for launch speed. Strategic brokerage website development optimizes for longevity and regulatory stability. Those are fundamentally different objectives. For detailed cost considerations, see our analysis of brokerage website development costs in 2026.

6. Multilingual and Multi-Jurisdiction Architecture Is Baseline

Most regulated brokers operate across multiple regions.

Modern brokerage websites must support:

Structured multilingual CMS architecture

Accurate hreflang implementation

Jurisdiction-specific disclosures

Entity-based segmentation

Region-aligned marketing restrictions

Improper structuring can cause:

SEO cannibalization

Duplicate content

Cross-border compliance issues

Marketing violations

Localization is not optional expansion. It is baseline infrastructure.

Retrofitting multilingual logic after launch often costs 30–50% of the original build.

7. SEO and Generative Engine Optimization (GEO)

Search behavior is evolving.

AI systems increasingly extract structured answers directly from broker websites. Visibility now depends on clarity and extractability—not keyword density alone.

Broker websites should include:

Clear FAQ sections

Structured heading hierarchies

Schema markup (Organization, FAQPage, BreadcrumbList)

Contextual internal linking

Well-organized educational content

As AI-driven search tools from OpenAI, Google, and Anthropic summarize broker information, structured clarity outperforms verbosity.

Generative Engine Optimization (GEO) is becoming foundational.

8. Templates vs Strategic Brokerage Development

Template-based websites can reduce upfront cost and speed launch.

They may suit:

Early-stage brokers

Offshore-only entities

Short-term campaign projects

However, regulated brokers typically require:

Custom compliance hierarchy

Deep trading platform integration

Multi-jurisdiction scalability

Conversion-engineered UX

Short-term savings often translate into rebuilds within 12–24 months.

A realistic cost comparison frequently shows that strategic builds—while higher upfront—reduce long-term technical debt and operational disruption.

Common Strategic Mistakes

Treating compliance as a checklist instead of architectural logic

Overinvesting in visuals while neglecting UX structure

Selecting platforms based on familiarity rather than scalability

Ignoring mobile-first realities (60–70% of traffic is mobile)

Launching without structured analytics and conversion tracking

Separating website launch from CRM and trading integrations

Underestimating multilingual and jurisdiction complexity

In regulated trading environments, your website is measurable acquisition infrastructure.

2026 Brokerage Website Development Checklist

Before launch, verify:

Regulatory

Compliance hierarchy structured

Jurisdiction disclaimers validated

Risk disclosures prominently integrated

Performance

Core Web Vitals optimized

Mobile performance tested

CDN implemented

Integrations

CRM synchronization active

MT4/MT5 or cTrader integration connected

KYC workflow tested

Payment automation validated

SEO & GEO

Structured data implemented

Internal linking defined

XML sitemaps configured

Hreflang validated

Operations

Backup systems in place

Staging environment established

Team CMS training completed

Analytics tracking functional

If your current website does not meet several of these criteria, a structured audit may reveal hidden performance or compliance risks.

Planning Your Brokerage Website for 2026

Brokerage website development now intersects:

Compliance engineering

Behavioral UX

Performance optimization

Multilingual SEO

Trading platform integration

For regulated brokers, the website is no longer a marketing layer. It is operational infrastructure.

Firms that architect strategically build once—and scale. Firms that prioritize speed over structure often rebuild repeatedly.

When evaluating your 2026 roadmap, consider:

Can your current structure support an additional regulatory entity?

Does your onboarding logic align with CRM attribution?

Are your compliance disclosures clearly extractable by AI systems?

Would a licensing audit view your site as structured—or improvised?

These questions often surface architectural gaps that are not visible during daily operations.

If You're Evaluating a 2026 Brokerage Website Strategy

Specialized fintech agencies bring experience navigating:

Regulatory reviews

Trader conversion optimization

MT4/MT5 integrations

Multilingual compliance frameworks

For firms operating in regulated environments, structural clarity reduces regulatory friction, improves acquisition efficiency, and prevents costly rebuild cycles. Understanding the difference between fintech web design agencies and generic web studios clarifies what specialized expertise delivers.

If you're assessing whether your current website can support your next phase of growth, a structured discovery conversation can clarify where risks or opportunities exist.

Final Perspective

In 2026, brokerage websites are not pages.

They are regulated systems that influence licensing outcomes, trader trust, acquisition efficiency, and operational stability.

The firms that treat them as infrastructure build once and scale. The firms that treat them as marketing collateral tend to rebuild under pressure.

If growth, compliance stability, and acquisition efficiency matter to your brokerage, website architecture deserves strategic planning—not cosmetic updates.

FAQs

How long does brokerage website development take in 2026?

Most modern builds take 4–8 weeks from discovery to launch, including UX design, compliance review, development, and integration testing. Integration-heavy environments may require 3–6 months depending on complexity, particularly when connecting proprietary CRM systems, multiple KYC providers, and trading platform APIs. For a detailed timeline breakdown, see our step-by-step guide to creating a broker website.

What platform is best for broker websites?

Webflow and Framer offer strong performance and structured CMS control, with sub-2-second load times and reduced maintenance overhead. WordPress remains viable but requires active security and optimization management due to plugin dependencies and vulnerability exposure. Platform choice should align with integration depth and growth plans rather than familiarity. Strategic platform selection considers 24-month growth projections, multilingual requirements, and internal team capabilities.

Do regulators review broker websites?

Yes. FCA, CySEC, ASIC, and others evaluate disclosure clarity, marketing claims, and jurisdiction alignment during licensing and audits. They assess risk disclosure prominence, fee transparency, leverage communication, and entity separation. Missing or unclear compliance content can delay licensing by months and damage banking relationships. Regulatory review is why compliance architecture must be embedded structurally from day one.

How much does broker website development cost?

Strategic builds typically range from $30,000–$60,000 depending on scope, including core integrations, CMS setup, and compliance architecture. Complex multi-jurisdiction builds with extensive custom functionality may exceed this range, reaching $80,000-$150,000. Template approaches may appear cheaper initially ($5,000-$15,000) but often require complete rebuilds within 12–24 months, bringing total costs to $25,000-$55,000. For detailed cost breakdowns, see our analysis of what you should actually budget for broker website development.

Is AI website building suitable for brokers?

AI tools assist with prototyping, but regulated environments require structured compliance and integration logic beyond template automation. While AI tools can help with initial website creation, they cannot handle jurisdiction-specific compliance requirements, custom trading platform integrations, or the regulatory nuances that licensed brokers face. For mission-critical brokerage infrastructure where compliance errors have serious consequences, human expertise remains essential.

Whether you’re launching something new or improving an existing platform, we’re ready to discuss your goals and explore the best way forward.